Looking out the window of our co-working office in Cape Town, we stared at an unfinished highway bridge which, as we later learned, was started over 40 years ago. This road to nowhere seemed to us the perfect symbol of the only “emerging” market in the world that failed to grow its GDP per capita over the past decade.

On our first day in the country, a rainy Saturday, we sat in the dark at the Apartheid Museum for hours waiting for the lights to come back on. The employees explained that “load shedding” happens daily so that different parts of the country can take turns using electricity because of operational deficiencies at the state-owned utility company. Aside from inconveniences this caused us – such as increased traffic jams from non-working stop lights – several companies cited this as a major inhibitor to productivity.

Three days later, we listened to the country’s president speak in the same square where Nelson Mandela addressed the people upon his release exactly 30 years earlier. In his speech, the president committed to destroy one of the most fundamental institutions – property rights – by expropriating land without compensation from white owners and giving it back to the natives. While many people believe this is nothing more than political rhetoric meant to secure populist support, the fact that such a possibility is entertained undermines people’s willingness to invest in assets which could simply be seized.

It’s a disgrace to Mandela’s legacy that his political party has been plagued with severe corruption. After years of being marginalized, leaders of the anti-apartheid political movement have been extracting value for themselves instead of strengthening inclusive institutions. For example, after ruling for nine years the previous president was forced to resign on substantial allegations of fraud, racketeering, and money laundering. Perhaps it’s difficult to support a family of four (official) wives and over 20 children on a politician’s salary without side gigs. Some were hopeful that the new president who took office two years ago could turn things around, but he has struggled to make any meaningful impact so far.

What’s worse is that there is no credible opposition party which could take the lead. Towards the end of our first week in South Africa, we witnessed a spectacular train wreck as a minority far-left party took the State of the Nation address hostage for nearly two hours before leaving in protest and finally permitting the president of the country to speak. Among their demands were expulsion of the last apartheid-era president in attendance who had claimed the week before that apartheid was not a crime against humanity, and the removal of the minister of public enterprises responsible for the utility failure. While their disruptive tactics were hostile and aggressive, they nonetheless raised awareness of – and symbolized – the dire state of the nation.

Many of these problems stem from decades of institutionalized racism which only ended 25 years ago. Measures to remedy this history have largely failed, and racism is still very strong. We heard many stories of -- and personally witnessed -- hidden and explicit racial discrimination, both direct and reverse, in public, the workplace and government. Observing this situation in what has become the most unequal country in the world marked a stark contrast for us given that we manage a fund based in Finland, one of the most equal countries in the world.

South Africa’s unemployment rate has steadily increased over the past decade to a staggering 30% today (and nearly 60% for youth), essentially the highest of any country in the world. And keep in mind that this figure doesn’t factor in discouraged workers who have given up looking for work, so the actual situation must be even worse than these numbers indicate

Of the nine emerging markets we’ve lived in over the past nine months, we felt the least safe in South Africa. We couldn’t have cellphones in our hands without passersby warning us to keep them in our pockets, Uber drivers would recheck at every intersection that the doors were locked and shared stories about violence they had personally experienced, and security guards told us to wait inside for our car and insisted on escorting us the 10 meters to the street. The situation seemed to have deteriorated since our previous two trips over the past three years.

Of hundreds of people we met in South Africa, no one was optimistic about the country’s future. One very experienced CEO who grew up in Zambia said that from his observations it’s more likely that existing institutions will keep deteriorating than that the rest of the country will improve. Many CEOs said they want their kids to leave the country and cited skilled emigration as one of the major human capital risks to their business. This brain drain may well be the final nail in the coffin for any hopes that this country ever emerges.

Burton Flynn and Ivan Nechunaev in the Johannesburg Bloomberg office where they met with a financial reporter to discuss macro issues

Burton Flynn and Ivan Nechunaev in the Johannesburg Bloomberg office where they met with a financial reporter to discuss macro issues

Scrappy brothers thriving in a difficult environment

Given this dismal situation, if we were macro investors, we would simply have no interest in South Africa. However, as bottom-up investors we travel the globe in search of great businesses at low valuations, and the fact that very few investors are looking at South Africa is actually good for us. After meeting nearly a hundred companies during our month in South Africa, we managed to find one that delivers promising results in spite of the depressing external environment.

This defensive business, set up as a real estate investment trust, is a self-storage asset owner which should continue growing despite likely future domestic economic issues, as the business is driven by life-changing events such as marriage, separation, having a child, doing renovations, starting a small business, or expanding a business. These life-changing events can be positive or negative, and continue to happen whether the economy is expanding or contracting. The company’s partial exposure to another underpenetrated market outside of South Africa provides an additional hedge against currency devaluation which, we believe, is likely.

The company’s founders, who serve as the CEO and CFO, are two young brothers who grew up in a working-class family. After six months of mailing letters, they convinced the state-owned utility company to sell them an uninhabitable lot sitting under power lines for €120,000, which they scrambled to scrape together. They then innovatively applied the condominium model of pre-selling a portion of the units to come up with a down payment for the loan to build a €3 million self-storage facility, which turned out to be a success.

After researching the industry in other countries and personally visiting every one of the 100 South African self-storage facilities they found in the yellow pages, they became convinced of the huge opportunity in this nascent market and have grown the business to 66 properties over the past 13 years. The competitive siblings, who run ultra-marathons, now dominate the market, and continue to consistently expand the number of properties in high-quality locations. Additionally, they have built a core competency in digital marketing in order to generate inquiries which they believe to be the crux of the business, and they deliver a 10% dividend yield to shareholders.

Meeting with the CEO and CFO brothers of a €300m storage asset owner and operator

Meeting with the CEO and CFO brothers of a €300m storage asset owner and operator

A €1,700 view of the market

A month before our trip we reached out to our broker to discuss our plans. When we called back to continue the conversation the next day, we were surprised to hear that they had closed up shop that morning. However, having our broker go belly up made sense given the dearth of foreign investor interest in South Africa. Even without a broker, we managed to meet with 90 listed companies in Johannesburg and Cape Town.

Our trip was quite timely. In addition to seeing the 30-year Mandela release anniversary speech and State of the Nation address, we also watched the much-anticipated National Budget Speech in which the finance minister committed to cut fat in the government and spar with the unions. To better understand the risks of investing in a country with so many macro indicators flashing bright red, we met with the central bank governor, finance ministry, securities regulator, commissioner for black economic empowerment, president of the local CFA society, UN PRI head of Africa, Finnish ambassador, leading finance and economics professors, local fund managers, financial reporters, and a dozen alumni from our business school involved in social impact initiatives and other local businesses.

We invited a well-known local markets commentator, the head of the Centre for Risk Analysis, to exchange views on the market over coffee. However, he requested €1,700 for the chat – the only such response we've received in the past year of 200 such meetings. We wonder what perspective might be worth so much more than our insights from meeting hundreds of South African market participants which we were excited to share with him.

We also had the opportunity to meet the Warren Buffett of South Africa, known locally as the "Boere Buffett." Although he now has dementia, he still comes to the office every day. We were excited to receive a signed copy of the book in which he shares his investment advice, and to see the titles he is currently reading: Ray Dalio’s Principles and Allen Carr’s Easy Way to Stop Smoking.

Receiving a signed book from the “Warren Buffett of South Africa”

Receiving a signed book from the “Warren Buffett of South Africa”

Our ESG due diligence on South Africa

After meeting nearly a hundred companies during our month in South Africa, we managed to find one that delivers promising results in spite of the depressing external environment.

Climate change has greatly affected South Africa. Cape Town has suffered a serious water shortage crisis since 2015 as the result of a drought. Additionally, the entire economy is run on the state-owned utility’s coal-fired power plants damaging the environment, and until recently the government banned private renewable power generation.

To learn what the government is doing to address these environmental issues, we requested a meeting with the minister of environment. Her chief of staff responded to fewer than half of the 12 emails we sent over 3 weeks and gave us quite the runaround. We were finally told that the minister was made aware of our meeting request but that “she has not given an indication if the meeting can go ahead or not.” Puzzled by this response, we could only laugh when the CEO of a packaging company we were scheduled to meet had to cancel our meeting because he had “been summoned by the Minister of Environmental Affairs.”

We requested a meeting with the environment minister to learn what South Africa is doing to protect its natural treasures, like Pilanesberg National Park which we had the pleasure to visit one weekend

We requested a meeting with the environment minister to learn what South Africa is doing to protect its natural treasures, like Pilanesberg National Park which we had the pleasure to visit one weekend

The biggest social problem facing the country is clearly the massive economic inequality stemming from the apartheid era of institutionalized racial segregation. For example, while whites account for only 8% of the population, they control the vast majority of the nation’s wealth. To learn what is being done to reduce this inequality, we met with the commissioner of the Broad-Based Black Economic Empowerment (B-BBEE) Commission, an affirmative action body that enacts regulations helping black people gain employment, develop skills, and own more businesses.

The commissioner herself is a beneficiary of affirmative action programs. A poor black college-aged student at the end of apartheid from a family with absolutely no financial resources to pay for her college education, she told us she was one of the first recipients of black empowerment scholarships. Additionally, she was only able to get her first job through an affirmative action job posting, so she is very passionate about her mission to help others advance.

We learned from the commissioner that the progress in black economic empowerment has been far below expectations. Despite incentives put in place to promote black management and ownership, a rampant practice known as “fronting” formally puts black people in charge, or as “owners”, of businesses, but in reality the income keeps flowing to white beneficial owners through trusts and other structures. Although public companies produce impressive compulsory B-BBEE reports, many of them in fact abuse their black-friendly status, illegally claiming B-BBEE benefits and stealing underprivileged people’s opportunities.

Many people we spoke to believe that the only black people who the B-BBEE has economically empowered are a small number of politically connected families which have been given “empowerment shares” to boost black ownership ratings. Anecdotally, the richest black person in South Africa happens to be the brother-in-law of the current president of the country. Interestingly, the president is also the former chairman of the B-BBEE. Who knows, perhaps the current commissioner will also become the president one day – or maybe just a billionaire.

Meeting with the black economic empowerment commissioner

Meeting with the black economic empowerment commissioner

Our process for meeting companies involves reaching out to every investable listed company through the email listed on their investor relations website. Despite following up on unanswered emails 10 times (and yes, we do sometimes get replies on the 10th time apologizing for somehow overlooking the first nine), in most markets we only end up with responses from fewer than half of the companies. For this reason, we were incredibly surprised to receive responses from 114 of the 117 companies we reached out to. We hypothesize that this is either an indicator of good corporate governance – South Africa has long had a reputation for having not only the best corporate governance in emerging markets, but among the best in the world – or a sign of desperation (or possibly both).

To learn what has been the key to cultivating one of the world's most advanced corporate governance environments, we were excited to meet with the financial securities regulator. However, we learned that while maintaining best-in-class governance standards was a priority for them decades ago, they are aware of their “failing economy” and said “we are not really going to be as focused on sustainability if we can't make ends meet.” Their Maslow hierarchy needs are to feed people, build schools, and create infrastructure. In terms of ESG, “we're happy to lag behind the rest of the world,” they told us. This downward trend might indicate an ongoing corrosion of the system, especially in light of recent corruption scandals at companies such as Steinhoff.

Meeting with the financial regulator

Meeting with the financial regulator

Gender imbalance at the stock exchange

In our meeting with the stock exchange, we learned that gender imbalance is a problem at most listed companies in South Africa. The CEO of the stock exchange, who repatriated from Australia to give back to the country by making sure the exchange operates in line with the best global standards, co-chairs a UN initiative driving SDG financing, and is strongly focused on gender equality, both within the stock exchange itself and in the companies listed on the exchange. She joked that they may have even taken the whole gender equality concept a bit too far, as over 60% of the exchange’s board and executives are women.

Meeting with the CEO and CFO of the stock exchange

Meeting with the CEO and CFO of the stock exchange

More independent than the Bundesbank

In most markets, it’s almost impossible to get a meeting with central bank governors: they typically perceive themselves as high-flying executives too busy to meet with foreign investors. We therefore saw it as a sign of transparency when the South African central bank governor accepted our meeting request via a cold email.

We were interested to hear the governor’s view on next month’s potential credit rating downgrade’s impact on the economy. He told us that in his adverse scenario he expects a two-year recession resulting from rate hikes to combat inflation spurred by currency devaluation, which would be caused by capital outflows triggered by South Africa’s exclusion from the government bond index. However, a recent banking sector stress test found the financial system to be robust enough to withstand that case. The best-case scenario would be that all the “good money” has already left the country, and inclusion in the speculative grade index might even bring in more – albeit volatile – funds, so the downgrade impact could end up being insignificant. The governor said that he plans for the worst but hopes for the best.

The central bank has been able to keep its reserves stable, though it’s at the bottom end of its comfort range. As this could be a trigger for currency devaluation, we asked the governor for his expectation of the exchange rate over the next year. We were surprised to hear him say that he long ago gave up modeling exchange rates. We suppose that if the central bank governor can’t predict what will happen to the country’s currency, perhaps nobody can.

The governor sees a global pattern of central banks being under attack – from the ECB governor accused of playing politics when warning about the disorder Brexit could bring, to the governor in India who didn’t do what the government wanted and eventually resigned under pressure, to the Fed being attacked by Trump over Twitter. When we asked about the degree of independence of the South African central bank, the governor claimed that they are “more independent than the Bundesbank” whose independence is an act of parliament which can be changed by a simple majority vote, while South Africa’s is written in the constitution and a change would require not only a supermajority but also a constitutional court ruling. He assured us that there is no political influence on monetary policy decisions, and told us that politicians have learned not to talk about rates: there used to be a governor that, whenever politicians would say he must cut rates, he would hike them. There also seem to be checks and balances in place: after a deputy finance minister commented about the interest rates last year, he was told by a parliamentarian that he had “crossed the boundary” and subsequently retreated and apologized.

The governor has learned over time that it doesn’t matter how well-protected an institution is by law and the constitution – respect of the public is earned. That’s why he has spent a lot of time over the past three years going out to the “far-flung areas of the public” to communicate the role of the central bank to the society and demystify monetary policy in order to entrench the institution’s credibility. He also shared that they organize a challenge whereby schools from various provinces compete in a monetary policy contest. When we asked if that’s how the bank makes decisions on interest rates, we were relieved to hear that it’s just a game.

The risks to the financial sector which emanate from climate change – including how drought, fires, and floods might affect the insurance industry and the broader financial sector – are considered in the central bank’s long-term economic projections. The governor shared that his bank is a part of the Network for the Greening of the Financial Sector, which is a growing network of dozens of central banks and financial regulators trying to get to grips with these issues. When we asked if the Fed is a member of the network, he joked “I’m sure they would like to be but we understand why they are not.”

The governor stated his purpose in life is to be a public servant, and that if he were to leave formal public service, he would still find a way to serve the public in a personal capacity. He laments the period of “state capture” when a lot of capable and honest public servants were pushed out of their public service, because “when you undermine the capacity of the state to provide public services, you are actually condemning the poor who really depend on public services.”

Meeting with the central bank governor

Meeting with the central bank governor

Green gold grows on trees

Extracting natural resources is core to South Africa’s economy. Given that ESG-conscious investors and lenders are posing a threat to mining businesses, it is ironic yet understandable that these companies have some of the most polished ESG narratives.

One gold mining company’s CEO struggled to recount their ESG policy until his IR fetched an elaborate slide that seemed to have been crafted by an expensive third-party consultant. The slide beautifully represented the company’s ESG strategy through an illustration of a tree where 1) the values of commitment, accountability, respect, enabling, and safety are depicted as the roots of the business; 2) the trunk of the tree, symbolizing the employees, gives it direction and strength; 3) the core of the business is built by safety, costs, quality, and volume; and 4) the canopy protects all nine stakeholders and the environment. Ideally, if the company gets it right, 5) the business will bear fruits to each stakeholder, fulfilling its vision of superior stakeholder value creation and improving communities and the environment.

This complex tree analogy was inspirational, but we wonder whether such a sophisticated ESG message metamorphoses into the improved lives of each of the 88,000 mostly underground workers struggling to make ends meet and risking their lives daily.

Meeting with the CEO of €7b gold mining company that outlines their ESG policy in an impressive “ESG tree”

Meeting with the CEO of €7b gold mining company that outlines their ESG policy in an impressive “ESG tree”

While most coal companies are being nudged by ESG investors, one CEO is taking a different approach: instead of investors trying to change the company, the company is trying to change investors. The CEO has been on a mission to help short-term focused investors understand and appreciate his strategy to transition to a 100% renewable energy company. What has led to his unique approach? For one, he is not an industry veteran. This son of a religious minister is a software engineer turned banker who only got into the coal industry 10 years ago. Secondly, he says the way he sees the world has significantly changed since having grandchildren, as he wants to be a part of creating a world they want to live in.

In every meeting, we ask about the biggest human capital risk the CEO worries about. Most answers focus on top management, and one CFO told us that the biggest human capital risk his CEO worries about is himself. After we stopped laughing, we realized that he wasn’t joking. In contrast, this coal company’s CEO was one of the few whose answer focused on the impoverished mining-dependent communities in an economy that’s not growing. He worries about disruptions, riots, and boycotts, and intends to use his resources to enhance people’s livelihoods while minimizing business disruption risks. Right now he is hyperfocused on leaving a legacy and says his purpose in life is to empower people and generate positive impact.

Meeting with the CEO of a €1b coal mining company. Standing next to the only other copy of the famous statue located in Nelson Mandela Square in Johannesburg

Meeting with the CEO of a €1b coal mining company. Standing next to the only other copy of the famous statue located in Nelson Mandela Square in Johannesburg

Blatant greenwashing

For some reason, only about one in four people at companies we met in South Africa gave us business cards. In other markets everyone has them. We were perplexed and the companies struggled to explain why such a business card habit – or a lack thereof – has become institutionalized.

When we did get the cards, we observed several times the practice of combining the executive functions of investor relations and corporate communications with “head of sustainability”. To us, this combination clearly communicates how the leadership thinks about sustainability: ESG is about communicating nicely framed outward messages to investors. We think a much more sensible approach is to house professional sustainability experts within the risk management division, not among the storytellers.

Meeting with the investor relations, communications, and sustainability executives of a €500m logistics company

Meeting with the investor relations, communications, and sustainability executives of a €500m logistics company

Making shoes for barefoot children

Given that we met 67 CEOs, we had the pleasure of getting to know a great variety of inspirational, progressive – and sometimes peculiar – leaders. An interesting observation we made was that many South African CEOs we met came from modest backgrounds, often having grown up in broken homes and in remote South African towns. One CEO was adopted from an orphanage, another had an abusive alcoholic father, some had to support their families from a very young age, and many suffered because of apartheid discrimination. What unites them is that they fought hard to get where they are and now inspire thousands of employees, leading by example.

The CEO of a €1b healthcare company stated that social responsibility of a business helps solve problems created by the government’s inability to provide minimal social welfare. In addition to supporting rape victims (a major problem in the country), his company recycles IV drip bags to produce shoes for children, a big need given that seven million South African school-aged kids walk to school barefoot every day. At the end of our meeting, the CEO gave us two pairs of these recycled shoes to give to children on the street.

Meeting with the CEO of a €1b healthcare company that recycles drip bags to produce a million shoes for school kids

Meeting with the CEO of a €1b healthcare company that recycles drip bags to produce a million shoes for school kids

Before the CEO of an industrial property developer could answer our question “What do you love to do?”, his female CFO turned to him and said “Don’t say it!” He instantly blurted out: “Women!” – and proceeded to tell us that he was recently divorced. We wondered if this was a newfound passion since his divorce, or the cause.

A real estate trust’s CEO has a unique business. While most of his peers develop prime real estate in the wealthiest parts of town, he focuses on gentrification of broken properties in crime-plagued downtown Johannesburg. His efforts are paying off as he delivers a 17% dividend yield to investors, and an entire neighborhood has become much more secure, with dry cleaners, cafes, and other small businesses operating safely. When we walked down the street with this “slumlord”, he greeted everyone by name. He proudly told us that his properties are so nice that he would have his family live there (although they don’t). On our tour of his low-income rental development, we met a building manager whom the CEO hired after taking his boxing classes at a local gym. It turned out this manager is none other than a former two-time professional boxing world champion. Having this champ onboard might be the company’s competitive advantage as it surely improves the rent collection rates.

On a property tour with the CEO of a €300m real estate business and his boxing world champion building manager

On a property tour with the CEO of a €300m real estate business and his boxing world champion building manager

An IT company’s CEO told us about his personal safety experiences in Johannesburg. His car and house have been broken into nearly a dozen times, and his whole family was once held at a gunpoint in their own home. His company’s valuation is very cheap right now but the only reason he isn’t buying shares is because his children’s education abroad is very expensive – they have no plans to return to the country after all this trauma.

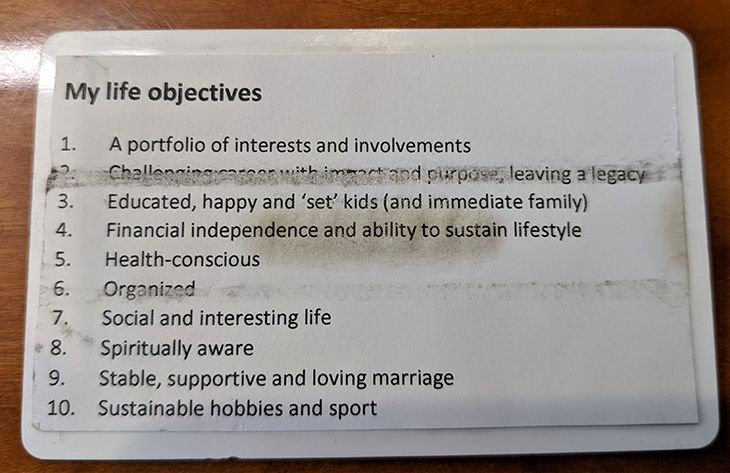

We ask every CEO we meet “What’s your purpose?” While some CEOs have to think on the spot and make up a purpose, many CEOs have a clearly defined purpose such as contributing to society, making an impact, or improving lives. When we asked one bank holding company’s CEO, he pulled out a card with ten life objectives he reminds himself of and follows daily.

A card with the life purpose of a €7b bank holding’s CEO which he carries in his wallet

A card with the life purpose of a €7b bank holding’s CEO which he carries in his wallet

Our view on coronavirus

We were tested for fever before getting off the plane upon our arrival in South Africa, and it wasn’t until a day before our departure that the first case of coronavirus was reported in the country. While the reported case was in Durban, 500km from Johannesburg, it caused an overnight behavioral shift. People stopped shaking hands, and we were asked by one company to report our recent travel history. We were happy to leave for our next country without any logistical coronavirus disruptions.

What caused our great concern, however, was that nearly every company we met during this month expressed fear that their operations would suffer from disruptions in global supply chains and complete uncertainty of how much their earnings would be over the next 12 months. This uncertainty will inevitably lead businesses to delay investment and consumers to delay consumption. After discussing these topics with nearly a hundred companies, our view is that there is extreme tail risk not yet priced into markets. We think this view informed by being on the ground is unique compared to what fund managers sitting in New York or London may be reading in the news on their Bloomberg terminals.

Meeting with the CEO and small IR professional of a €13b telecom company

Meeting with the CEO and small IR professional of a €13b telecom company

Our next stop

Having spent a month in each – the Philippines, Malaysia, Indonesia, Bangladesh, Pakistan, Thailand, Vietnam, Saudi Arabia and South Africa – we are departing to the tenth country in our effort to live in 12 emerging markets in 12 months. Stay tuned for... Turkey.

Learn more about our Evli Emerging Frontier Fund

Our recent blogs

A month in Saudi Arabia: Piercing the veil

A month in Vietnam: Closing the deal

A month in Thailand: Driving three hours to see an empty factory

A month in Pakistan: An altercation at the ministry of finance

A month in Bangladesh: We're investing billions in the world’s best stock market

A month in Indonesia: Offending Trump in Bali

A month in Malaysia: Finding another gem on "Treasure Island"

A month in the Philippines: How active management helped us beat the traffic (and the market)