“Investors from Norway-based ‘Evely Group’ have been visiting Bangladesh for an entire month. They will invest their $20 billion fund in Bangladesh and two other countries. They have grown to believe that Bangladesh is the most attractive market to invest, because Bangladesh stocks’ P/E ratios make them the best investments in the world.”

This is what an article in a popular local newspaper said about our month-long stay in Bangladesh. Almost every statement in it is incorrect: Evli Group is based in Finland, we invest a portion of Evli’s $15 billion AUM across more than a dozen emerging markets, and we are cautious investing in Bangladesh due to corporate governance concerns, unpredictable regulators, and strict exchange controls that make cash repatriation costly and lengthy (once it took us 7 months and a lot of paperwork to get capital out of the country). While we wouldn’t describe Bangladesh as the “most attractive market”, we agree with the message we read between the lines of this enthusiastic article: it’s never boring in Bangladesh.

Landing in Dhaka after midnight, spending 4 hours in a queue behind 50 Chinese citizens to get a visa on arrival, receiving a “VIP” offer from a charismatic imposter to skip the border control altogether, being asked at immigration whether we came to work at a nuclear power station, and then getting in a car accident and stuck in traffic at 5 a.m. for another 2 hours. This was the exciting reality that greeted us right upon arrival in Bangladesh’s bustling capital city. Our first company meeting was just two hours later.

Local newspaper article translated from Bengali that says we will invest billions of dollars in Bangladesh (we randomly learned about this article a week after it was published)

Local newspaper article translated from Bengali that says we will invest billions of dollars in Bangladesh (we randomly learned about this article a week after it was published)

Scandinavian quality at Bangladeshi prices

From the very first day in Bangladesh, one company’s name was constantly coming up in most of our conversations. This firm, a leader in Bangladesh’s telecom sector and subsidiary of a Norwegian multinational group, offers investors a 45% market share, continuous earnings growth, advancements in data business, healthy balance sheet, and robust corporate governance. Meeting twice with the CEO convinced us of the company's leadership strength, while personal use of the phone and data offering as well as additional surveys on the ground confirmed high network quality. At only 10x P/E, the firm’s stock looked like a bargain. However, there was one problem: the company has been in a longstanding dispute with the local telecom regulator that wants to claim from it $1.5 billion of allegedly unpaid fees dating back many years.

This controversial conflict appeared to be the only major factor dragging the stock price down. We discussed it further with over 20 local sources including lawyers and government advisors, most of whom explicitly told us that the regulator’s predatory accusations have no reasonable grounds. Additionally, during our stay in Bangladesh the finance ministry announced its commitment to mediate the dispute and get it resolved “within weeks”. We see any further positive regulatory advancements as a direct catalyst to increase the stock price of this undervalued company that used to trade at 25x P/E before the conflict.

On the streets outside the €4.5b telecom company’s headquarters in Dhaka (the umbrella carries bright-blue branding colours of the firm’s Norwegian parent)

On the streets outside the €4.5b telecom company’s headquarters in Dhaka (the umbrella carries bright-blue branding colours of the firm’s Norwegian parent)

To boldly go where no investor has gone before

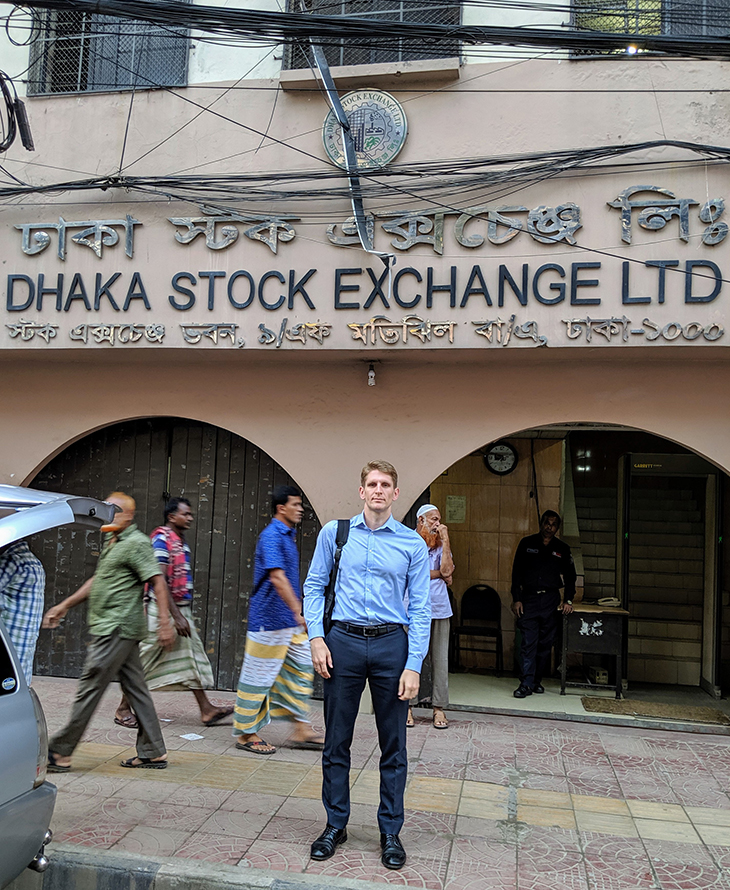

Our entire month in Bangladesh flew by in a whirlwind. Not only did we meet with the CEOs and management of 40 public companies, we also visited the local regulators and the stock exchange, made due diligence trips to factories and infrastructure facilities, and enjoyed informative dinners with hospitable business leaders and fellow business school alumni.

A common expression of surprise we received from our local contacts was that they had never seen foreign investors spend an entire month in Bangladesh, live in rental apartments as opposed to an expensive hotel, and use a ride-hailing service to get to the meetings. This is exactly what we were hoping for. Going where others won’t go and getting fully immersed in the authentic environment on the frontier to find great companies and better understand local business dynamics and country’s culture is what we do to deliver top performance for our investors.

Ivan Nechunaev spent a month in Bangladesh, searching for investments and analyzing in great depth this oft-overlooked market

Ivan Nechunaev spent a month in Bangladesh, searching for investments and analyzing in great depth this oft-overlooked market

Two camps of corporate governance

Meetings with local companies quickly separated them into two camps. The first camp includes transparent businesses with advanced corporate governance that are often backed by multinational corporations and foreign institutional shareholders. Such firms have established investor relations practices and their CEOs readily meet with investors because they see it as a fundamental duty of a publicly listed company and an opportunity to receive feedback from stakeholders. They know what “ESG” stands for and produce detailed sustainability reports. There are roughly 15 such companies in Bangladesh; an open-door investor policy is essential for their reputation and stock price.

The second camp of companies includes the prevailing type of local issuers: typically with no foreign shareholders, often controlled by a family, with very remote understanding of what a publicly listed status entails when it comes to investor communication, and with bright-red corporate governance flags. These companies like to ask foreign equity investors (such as ourselves) for soft loans, or exclaim “What’s in it for me?” when investors want to meet and learn more about their operations. Evidently, investor transparency – which we believe is a key element of good governance – doesn't seem to be valued at such companies’ headquarters (sometimes located in residential apartment buildings).

Meeting with the CEO and head of sustainability of a €700m bank that is well-known for its transparent investor communications

Meeting with the CEO and head of sustainability of a €700m bank that is well-known for its transparent investor communications

One shoe manufacturing company’s CEO was boasting about two important acquisitions to be made in the next two months. However, when asked whether the company secured the equity or debt financing to do so, he said that he was still thinking about how to finance the deals and where to find the money. His next statement was alarming: on behalf of the company, he was going to acquire two assets that he owns in his individual capacity – at “fair valuations”. Another company’s head gave us a very special business card: it listed all the companies of which he is the CEO... all 26 of them! We sighed: running 26 companies signals misalignment of interest and lack of management focus. A third company would not “entertain” scheduling a meeting with us on a set date and instead told us to “walk in” during business hours on any given day. Not to much of our surprise, management was not available when we showed up.

While most investors – if they ever come to Bangladesh – only meet with a select few companies from the first camp, we are very happy to have met companies from the second camp as well. First, this experience provides a great perspective on real-life corporate governance in emerging markets, helping enhance our corporate governance assessment framework. Second, it is an excellent opportunity to raise ESG awareness and provoke sustainability thinking among these lagging businesses that had never heard about ESG before. And third, it is useful in analyzing the state of capital markets in Bangladesh, which is very relevant for our macro risk management process. Spending time on the ground to distinguish between true gems and pirates’ gold is not a luxury – for a prudent emerging markets investor it is essential.

Meeting with an €700m paint manufacturer’s CEO and CFO who meet investors “out of courtesy”

Meeting with an €700m paint manufacturer’s CEO and CFO who meet investors “out of courtesy”

Eating fish from an acid lake

While there are valid corporate governance issues in Bangladesh, we also witnessed positive sustainability developments. In a meeting with the Bangladesh SEC commissioner, we learned that instead of requiring companies to publish sustainability reports at a time when most simply don’t have sufficient resources and knowledge to do so, the SEC regularly integrates new ESG disclosure requirements into the local corporate governance regulations, helping companies adapt to new reporting standards without completing additional forms (yet). In our meeting with the head of Dhaka Stock Exchange (DSE), we were told that 75 listed companies voluntarily attended a recent sustainability reporting workshop held at the DSE. In 2018, after welcoming a Chinese consortium of stock exchanges as their new 25% shareholder, DSE also joined the Sustainable Stock Exchanges initiative of the UN, formally committing to promote long-term sustainable investment and advanced ESG disclosure practices in Bangladesh.

We see these developments as promising signals for the Bangladesh market’s future. However, we made sure to communicate to both the SEC and DSE that there is a lot of work to be done to improve financial reporting transparency as well as investor relations and ESG practices in the country.

Among the companies, a sulfuric acid manufacturer we visited on a weekend particularly stood out for their pragmatic sustainability practices. At the company’s factory outside Dhaka, we were served fish which came from the lake on the factory’s premises. Touring the manufacturing facilities after lunch, we saw a new water treatment plant which recycles the acidic water and either brings it back into the production system or sends it into the lake from which the fish came! A panic attack almost ensued, but learning that the CEO and his employees eat fish from this lake daily (and everyone seems to be healthy) was a relief and a testament to the purity of the company’s modern recycling processes.

Visiting a €70m sulfuric acid manufacturer (a typical factory tour in Bangladesh starts with CEO only and ends with a tail of 20 employees)

Visiting a €70m sulfuric acid manufacturer (a typical factory tour in Bangladesh starts with CEO only and ends with a tail of 20 employees)

A bridge that boosts GDP by 2%

In recent years, Bangladesh has impressed the world with its strong economic expansion (in 2018, its 7.9% GDP growth was third-highest across 193 countries). Part of this growth comes from the government’s commitment to improve the country’s infrastructure: Bangladesh is currently executing several projects that include bridges, highways, power stations, sea ports and mass transit systems. Of note is the increase in foreign direct investment (FDI) received by Bangladesh from China, which has grown to be the largest investor in the country with over $1 billion committed in 2018 (a significant increase from just over $100 million in 2017, though still pale in comparison to $20 billion our fund will allegedly invest in Bangladesh).

To see the progress in Bangladesh’s infrastructure with our own eyes, we went to see the Padma Bridge, a megaproject of intense scale and complexity that is expected to contribute up to 2% to the country's GDP once completed in 2021. Constructed by none other than a Chinese company, this bridge will link two banks of the Padma River in a highly strategic location, improving regional economic inclusion and boosting trade between Dhaka and 21 southern districts through a 10-minute connection by car and rail instead of the current multi-hour ferry ride.

Traveling to this impressive site a few hours from the capital city by land and water on a rainy weekend is an example of what we do as investors to better understand our markets and their growth catalysts. Assessing the bigger picture and understanding macro risks supplements well our search for great companies with deep value, sustainable growth and sound ESG practices.

Visiting Padma Bridge, a €3b megaproject that is expected to boost the GDP of Bangladesh by up to 2%

Visiting Padma Bridge, a €3b megaproject that is expected to boost the GDP of Bangladesh by up to 2%

Sitting down with a Nobel Peace Prize laureate

Working in emerging markets always gives us precious opportunities to meet with humanity’s brightest minds and biggest hearts. Bangladesh was not an exception. On one of the evenings in Dhaka, after a lengthy day of company meetings, we met with Muhammad Yunus – Nobel Peace Prize laureate who is widely considered to be the father of microfinance.

Sitting down one-on-one with Dr. Yunus, we discussed his earlier engagement as a United Nations Sustainable Development Goals Advocate and learned more about his views on the purpose of business. One of the world’s most influential thinkers, Dr. Yunus shared with us his belief that only the businesses that selflessly serve the interests of people and other stakeholders can succeed over time, and that all investors must stay true to their humane values and embrace ESG-minded investment practices focused on positive stakeholder impact. Insights from this meeting gave us helpful food for thought in our continuous strive to be more responsible and more impactful investors.

It was especially fitting that we visited Professor Yunus in his beloved home country of Bangladesh – a country of people with big hearts who tirelessly work to change their homeland for good. We were tremendously impressed by the hospitality and genuine friendliness of Bangladeshi people and look forward to returning to the country in the future.

Meeting with Dr. Muhammad Yunus, native and resident of Bangladesh and 2006 Nobel Peace Prize laureate

Meeting with Dr. Muhammad Yunus, native and resident of Bangladesh and 2006 Nobel Peace Prize laureate

Our next stop

Having spent a month in the Philippines, Malaysia, Indonesia, and Bangladesh, we are departing to the fifth country in our effort to live in 12 emerging markets in 12 months. Stay tuned for... Pakistan.

Learn more about our Evli Emerging Frontier Fund

Our recent blogs

A month in the Philippines: How active management helped us beat the traffic (and the market)