10 months after starting our initiative to live in 12 markets for one month each, our venture was cut short as a result of the pandemic. By that point, we had managed to meet 632 companies in the Philippines, Malaysia, Indonesia, Bangladesh, Pakistan, Thailand, Vietnam, Saudi Arabia, South Africa, and Turkey.

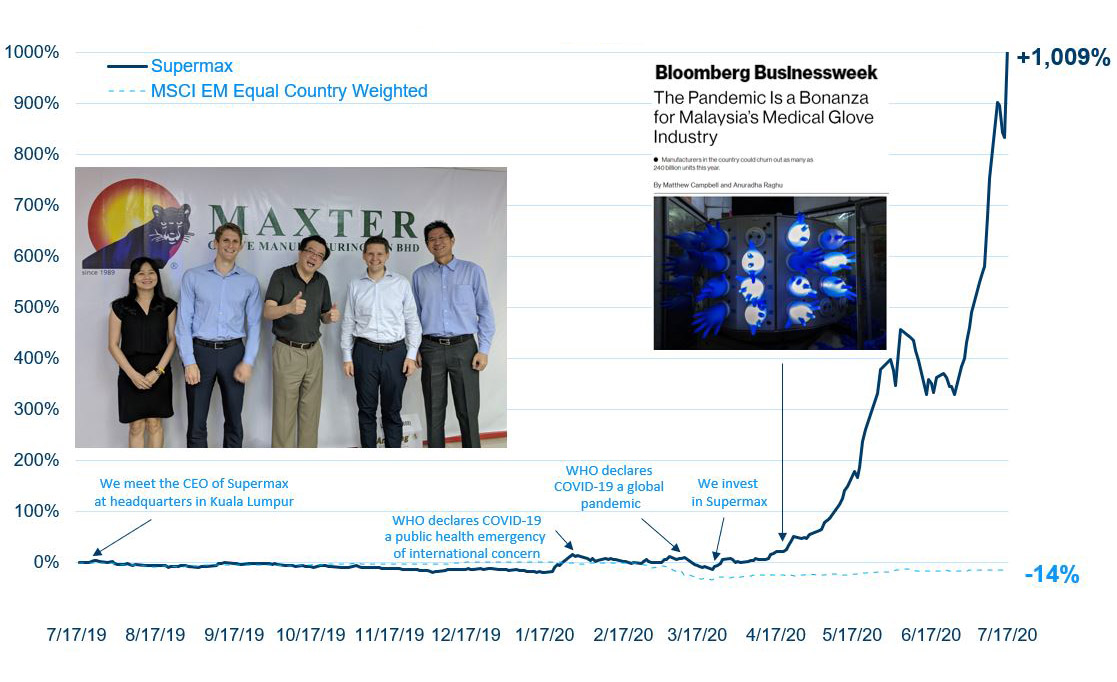

As soon as the pandemic was declared, our mission was to determine for which of the 632 companies COVID-19 was an opportunity rather than a threat. It didn’t take long to identify that the four medical glove manufacturers in Malaysia (where 65% of the world’s supply is produced) stood to benefit the most as the demand for personal protective gear and hospital supplies has skyrocketed. Of these four which we met last July, one – which had just recently announced a land acquisition to expand capacity – was trading at 22x LTM EPS while competitors traded at 53x, 43x, and 28x. Its stock price was shockingly flat since the beginning of the crisis and we were surprised that almost no sell-side research had recognized the opportunity. It took a Bloomberg article a month later to raise awareness. Since we acquired this position at the end of March, the stock has increased by 1,000%.

Supermax total return

(7/17/2020–7/17/2020)

Supermax is a great example of inefficient markets which paid off for our investors

Active management of the pandemic

During the crisis drawdown period, our fund lost 39% compared to the average emerging market which was down 37%. As we wrote in our monthly update, we were surprised by the similar performance given that our portfolio was comprised of cheaper, higher quality, and faster-growing companies than the average: our fund’s average P/E was 5x (the 3rd lowest out of 650 emerging market funds’), EPS growth was +4% (compared to the EM index’s -12%), and ROE was 21% (double that of EM’s 11%). Additionally, nearly 40% of our portfolio companies had net cash, and their average net debt to EBITDA was only 0.5x (compared to 2.0x for EM).

In March, we reacted to the crisis by selling an airline and an airline baggage handler in Turkey due to grounded flights and potential lack of full demand recovery (we sold our airline before Warren Buffett sold his), a Pakistani textile manufacturer due to loss of international orders, a Thai beverage bottler which serves the tourist-driven Phuket region, a Saudi rental car operator due to lighter traffic, an Egyptian holding company with a major energy segment due to Egypt’s macro risks amid oil price turbulence, and a Saudi mall operator due to store closures, a higher debt load, and struggling oil-dependent macro.

In addition to buying the Malaysian medical glove manufacturer, we used the proceeds from these sales to purchase a Turkish specialty chemical producer seeing increased demand for its products used in cleaning supplies amid European competitor factory closures, a Turkish convenience store operator seeing spiking demand from stockpiling, a Saudi hospital group resilient during a healthcare crisis, and a Turkish electrical contractor in which we had previously invested and whose stock price was undeservedly punished with valuation dropping to nearly 3x P/E and which we believed would also benefit from a significant increase in backlog and a potential government stimulus.

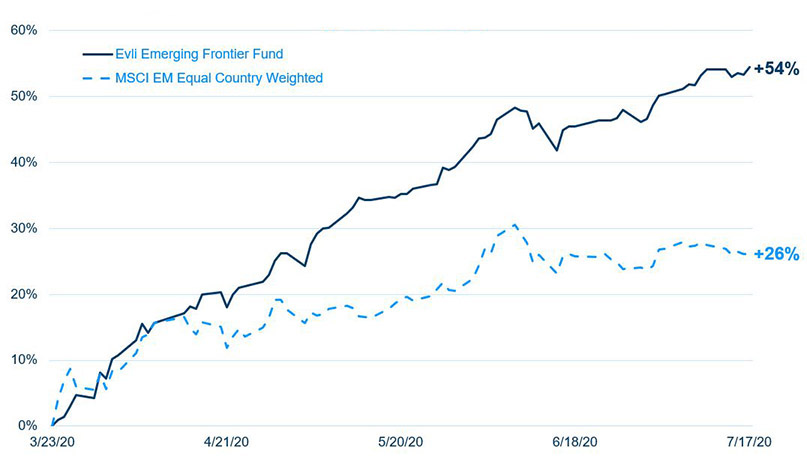

Due to our strongly positioned portfolio going into the crisis, and substantial contributions from the companies we added in March, since the trough our fund has returned over 50%, more than double that of the average emerging market and one of only 3 funds (out of all 764 emerging market funds globally with data on Bloomberg) which have managed to do so.

Evli Emerging Frontier total return since COVID-19 trough

(3/23/2020–7/17/2020)

Our fund has outperformed the average emerging market return by 28% since the crisis trough

Our fund has outperformed the average emerging market return by 28% since the crisis trough

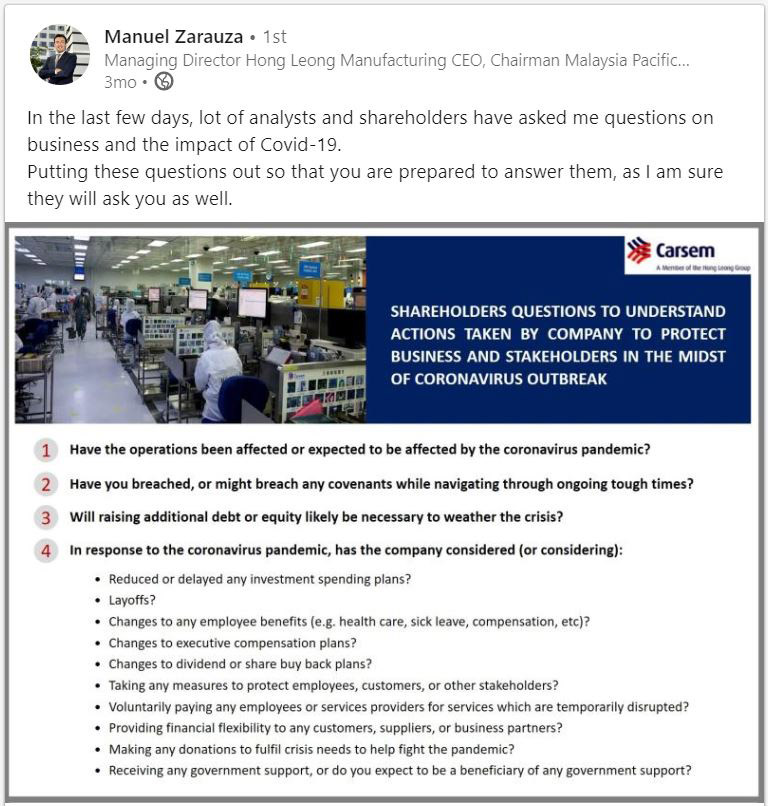

Our bottom-up perspective on the crisis

To continue repositioning our portfolio, we reached out by email in early April to all 632 companies we met over the past year, asking 13 questions regarding how the pandemic is affecting their operations, where they are making cuts, and how they are proactively supporting stakeholders and broader communities. The vast majority have been negatively affected but a few reported benefiting from the crisis – in addition to medical glove manufacturers, these included mobile operators (increased data usage from WFH), media broadcasters (increased viewership), essential food producers and retailers (cooking at home and consumer stockpiling), brokerage firms (increased trading), and tech and business process outsourcing (supporting WFH IT needs).

In June, we followed up with the 488 companies which responded, asking how much revenues declined in April and May, and when they expect to return to pre-crisis revenues. We were excited to dig into the 39 firms which actually saw revenues increase in April and May, as well as the seven firms which expected a full recovery in the second quarter.

We noticed that our questions were used by several companies in their press releases, investor presentations, and quarterly calls.

The CEO of a €500m Malaysian semiconductor company in our portfolio posted our original 13 questions on LinkedIn recommending that other CEOs be prepared to answer such inquiries

The CEO of a €500m Malaysian semiconductor company in our portfolio posted our original 13 questions on LinkedIn recommending that other CEOs be prepared to answer such inquiries

We documented our research takeaways in COVID-19 in emerging markets: Firm-survey evidence, a white paper which was recently published in the Centre for Economic Policy Research (CEPR)’s Covid Economics, a special academic journal designed to disseminate vetted scholarly work on the COVID-19 pandemic in real time.

One significant takeaway was that astute investors are able to capture excess returns in emerging markets which our research found to be far from efficient. Specifically, we found further evidence of the stock market being slow to incorporate publicly available information (just as in the case of the Malaysian medical glove manufacturer and other companies we added to our portfolio over the past several months). Investors such as ourselves outperformed by avoiding companies negatively affected by the pandemic and owning those which benefited.

Title page of CEPR’s Covid Economics, Issue 38 in which our research findings were presented

Title page of CEPR’s Covid Economics, Issue 38 in which our research findings were presented

Doing good and doing well

Another major finding we highlighted in our white paper is that companies which accommodate their labor force and seek to maintain long-term relationships with stakeholders experienced lower stock price declines, suggesting that the financial markets valued these stakeholder-centric companies more than their counterparts during the crisis. We think it’s possible that part of our strong performance throughout the crisis could be attributed to the fact that many of our portfolio companies are stakeholder-centric in nature.

For example, a Malaysian automation solutions provider – the largest weight in our portfolio – is seizing the pandemic opportunity by hiring engineering talent laid off by its competitors, thus enhancing R&D capabilities and removing the biggest obstacle to growth. Partially thanks to this recruiting effort, they recently announced an investment in a new medical device business, aiming to become a top-five global dual-safety pen needle manufacturer in just a few years.

The CEO of another portfolio company, a Turkish electrical contractor, watches the number of employees in his company daily: he has it written on the wall at the office reception to remind him of the people he is responsible for. It doesn’t hurt also that everyone can see that the company isn’t making mass layoffs, instilling a sense of trust and transparency among staff.

Burton Flynn and Ivan Nechunaev meeting with the CEO of a €50m electrical contracting company in Turkey who tracks the number of his employees daily by having it written on the wall at the headquarters’ reception (March 2020)

Burton Flynn and Ivan Nechunaev meeting with the CEO of a €50m electrical contracting company in Turkey who tracks the number of his employees daily by having it written on the wall at the headquarters’ reception (March 2020)

Several of our portfolio companies shifted their operations to fulfil pandemic needs. A brassiere company in Thailand started making face masks – first they were distributing them for free to help the government, and then selling various designs. An Indonesian lifestyle retailer also shifted their garment factory to make masks and PPE for medical professionals. A hydrogen peroxide producer in Pakistan launched a disinfectant, which not only has seen an overwhelming market demand but also was donated in large amounts to the government. And a South-African self-storage asset owner and operator made its properties available free of charge to NGOs for the storage of coronavirus-related supplies.

Consumer staples companies – such as a Malaysian egg producer and an Indonesian rice business – donated foods that they make. A Malaysian semiconductor company paid overtime rates to those who came to work, while a Saudi IT distributor kept paying those who couldn’t come to work because of lockdown, and a South African minibus taxi financing business provided loan payment relief for their taxi owners.

Meeting with the CFO and head of investor relations of a €600m South African minibus taxi financing company which provided loan payment relief to its clients (February 2020)

Meeting with the CFO and head of investor relations of a €600m South African minibus taxi financing company which provided loan payment relief to its clients (February 2020)

Defensively positioning our portfolio

Given that over the past year we met 632 companies, asked each one to complete an ESG questionnaire with over 100 questions, and reached out to each one with COVID-related questions (and followed up with the ones that responded), we have built intricate knowledge of our investment universe. Bottom-up stock selection helped us invest in cheap, growing, high-quality companies currently reflecting the following themes:

Technology: taking advantage of increasing digitization

Consumer staples: catering to the basic needs and benefiting from stockpiling

PPE manufacturers: spike in demand amid the pandemic

Broadcasting: increased demand for content amid TV channel production closures

Auto insurance: fewer cars on the road results in fewer claims

Specialty chemicals: increased demand for cleaning and disinfectant products

Brokerage: increase in trading volumes given the rise in volatility

Pharmaceuticals: generic coronavirus drug producer

Freight transportation: increase in rates given insufficient storage capacity on the market amid oversupply of commodities during economic slump

Infrastructure: benefiting from government infrastructure stimulus

Resilient business models: self-storage assets, minibus taxi that has no alternative in poor neighborhoods

Recovery stories: companies from various industries oversold during the panic selloff which have strong fundamentals and are positioned to benefit from the economic recovery

Idiosyncratic opportunities: non-COVID-correlated business cases

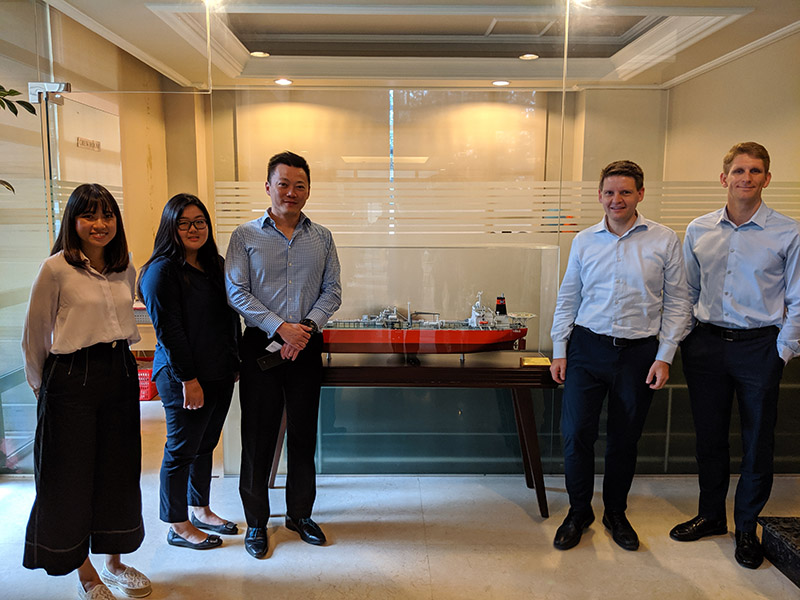

One of the obscure cheap growing firms we found – a €250m freight transportation company which owns 33 vessels in Indonesia – is benefiting strongly from the pandemic and expects 2020 earnings to increase 300-400%. Commodities consumption dropped sharply in H1 2020 while supply was still increasing – together with a shortage of tankers in the market this resulted in insufficient oil storage space, and the rates for tankers used as floating storage increased multiple times. In 2019, the company diversified its client base from 20% to 35% international clients (which pay 50% higher rates than the state-owned Indonesian corporation) and acquired 8 additional vessels. They also purchased another 5 vessels in Q1 2020 (which will contribute fully to Q2 results) and 3 vessels in Q2. Altogether, with higher rates and 142% greater effective tonnage, this marine operator whose LTM P/E stands at 6x while 2020 P/E is only 2x, has its own “perfect storm” amid the pandemic. The company’s ticker – BULL – tells you all you need to know.

We believe our portfolio is well-positioned to continue taking advantage of the opportunities the current market environment presents, and look forward to constantly refining and enhancing our investment process.

Meeting with the CEO and senior team members of the €250m Indonesian freight transportation company (August 2019)

Meeting with the CEO and senior team members of the €250m Indonesian freight transportation company (August 2019)

Learn more about our Evli Emerging Frontier Fund

Our recent blogs

A month in Turkey: Retreating from coronavirus

A month in South Africa: The road to nowhere

A month in Saudi Arabia: Piercing the veil

A month in Vietnam: Closing the deal

A month in Thailand: Driving three hours to see an empty factory

A month in Pakistan: An altercation at the ministry of finance

A month in Bangladesh: We're investing billions in the world’s best stock market

A month in Indonesia: Offending Trump in Bali

A month in Malaysia: Finding another gem on "Treasure Island"

A month in the Philippines: How active management helped us beat the traffic (and the market)