A short walk down the street from Evli’s headquarters in central Helsinki are the offices of several renowned global forest companies. Carry on walking out of the city and you will enter the forest, a vast expanse of trees that appears endless. Forests that grow some of the highest quality wood in the world. So why, in 2020, did Evli decide to launch a global forest fund instead of investing locally?

A global strategy for enhanced returns and greater carbon impact

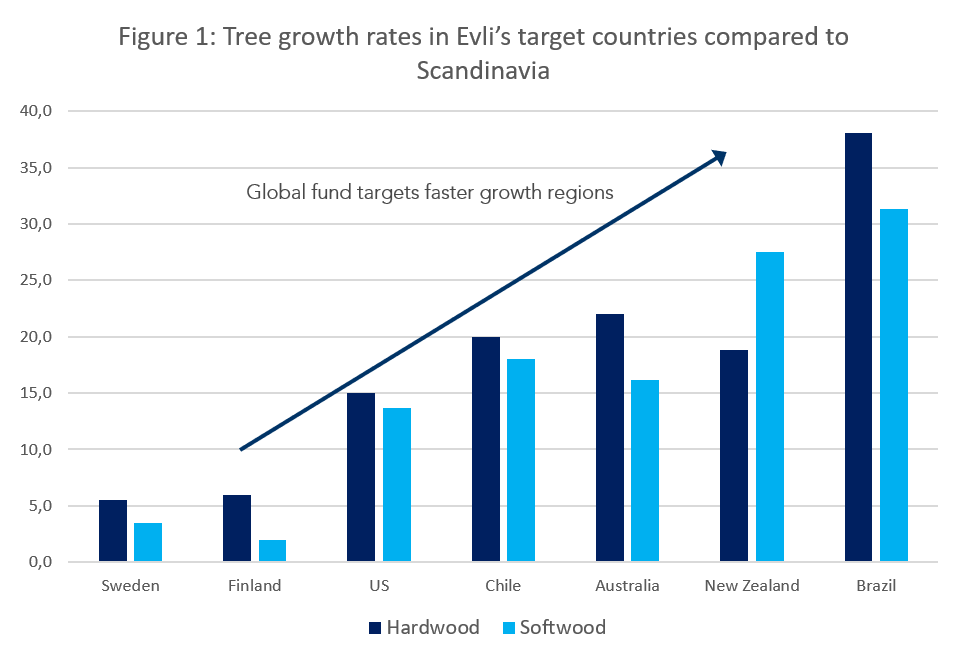

Around 60% of a forestry portfolio’s return is generated from the biological growth of the trees. Faster tree growth rates in Evli’s target regions, the US, South America, Australia and New Zealand can drive higher returns. Historically, US forestry has delivered over 8% annually compared to 4.5% in Scandinavia. Faster growing forests also remove more atmospheric carbon each year. A global portfolio enables Evli to target a carbon impact effect five times greater than investing locally.

A global fund also allows Evli to select from more diverse fund strategies, so that a portfolio targeting an annual return of 6% to 8% can be offered to our investors. A brief description of some of our investment themes follows.

New revenue streams from participation in carbon markets

There has been much talk about the value of carbon locked-up in forests. However, for forest owners to benefit, they need access to carbon markets. In our recent blog about Impact forest investments, we discussed how Emission Trading Schemes (ETS) have created a new source of revenue for forestry investors. Forest owners can be paid to leave the trees standing instead of harvesting by issuing verified carbon credits. Both mandatory (compliance) schemes and voluntary programmes exist. Because demand for compliance carbon credits is driven by regulatory obligations, their prices tend to be higher than those in the voluntary market. Europe has a compliance market, the EU ETS, but it does not recognize forestry as a source of carbon credits.

Conversely, in the California carbon market, forests are the source for around 80% of the credits issued. In the New Zealand ETS, forestry is also a major source of credits. For both schemes, only domestic forests qualify, one must have a global strategy to benefit. Evli’s Impact Forest Fund is building a pipeline, which will provide Nordic investors the opportunity to participate in these carbon markets. Early cash flow from carbon credits can add 200 to 300 basis points compared to traditional forest investments. Annual return expectations from fund strategies with exposure to carbon markets in the US are 8% to 10%.

Afforestation – planting new forests for carbon impact and higher returns

Planting bare land with trees to establish new forests (afforestation) is one way to achieve real carbon impact. In the northern hemisphere there is limited land available for afforestation. South America has large areas of degraded pastureland that can be acquired for private ownership. Institutional investors have been investing in forestry in the region for over twenty years. Abundant sunlight and rainfall provide excellent conditions for growing trees. The faster growth rates mean more carbon is sequestered annually, further advancing the carbon impact. Growth rates in Brazil can exceed 40 cubic metres per hectare per year, while in the Nordics the rate is typically under 5m3/ha/year. High growth rates and the efficiencies of plantation forestry enable annual returns exceeding 10% to be targeted in South America.

Diverse fund strategies and high biological growth delivers Evli's 6% to 8% target return

The outlook for global wood demand is robust. Society is looking for low carbon materials to displace steel and concrete in construction, single use plastics and fossil fuels. Wood has many of the answers to these needs. Evli’s global forestry fund provides Clients the option to invest in regions with faster tree growth rates and more diverse fund strategies that offer a higher return expectation. These two factors enable the construction of a forestry portfolio with a target annual IRR of 6% to 8%. Investors also benefit from an impact investment that can reduce the carbon footprint of their investment portfolios. The Evli Impact Forest Fund is classified as a dark green (Article 9) investment under the EU Sustainable Finance Disclosure Regulation (SFDR).

Oh, and you still benefit from low correlation to other asset classes, capital preservation and the inflation hedging characteristics that have always been an attractive feature of forestry. Read more: Evli's Roger Naylor: 4 reasons to invest in forestry

NB! Evli Impact Forest Fund is intended for professional investors and a limited number of non-professional clients who make an investment of at least EUR 100,000 and who are considered to have an adequate understanding of the fund and its investment activities.