The decade-and-a-half long growth equity dominance has come to an end. Valuation can no longer be ignored.

Valuation-oriented investors have had to endure a long market cycle of (eventually) high-priced, high-growth equity outperforming their more stable, lower-priced quality counterparts in the market. Sometimes, it has felt like being in endless detention, like in John Hughes’ iconic coming-of-age movie The Breakfast Club. You’re there killing time with some other kids while the drunk-on-authority Vice Principal threatens: “I’ve got you for the rest of your natural born life if you don’t watch your step!”

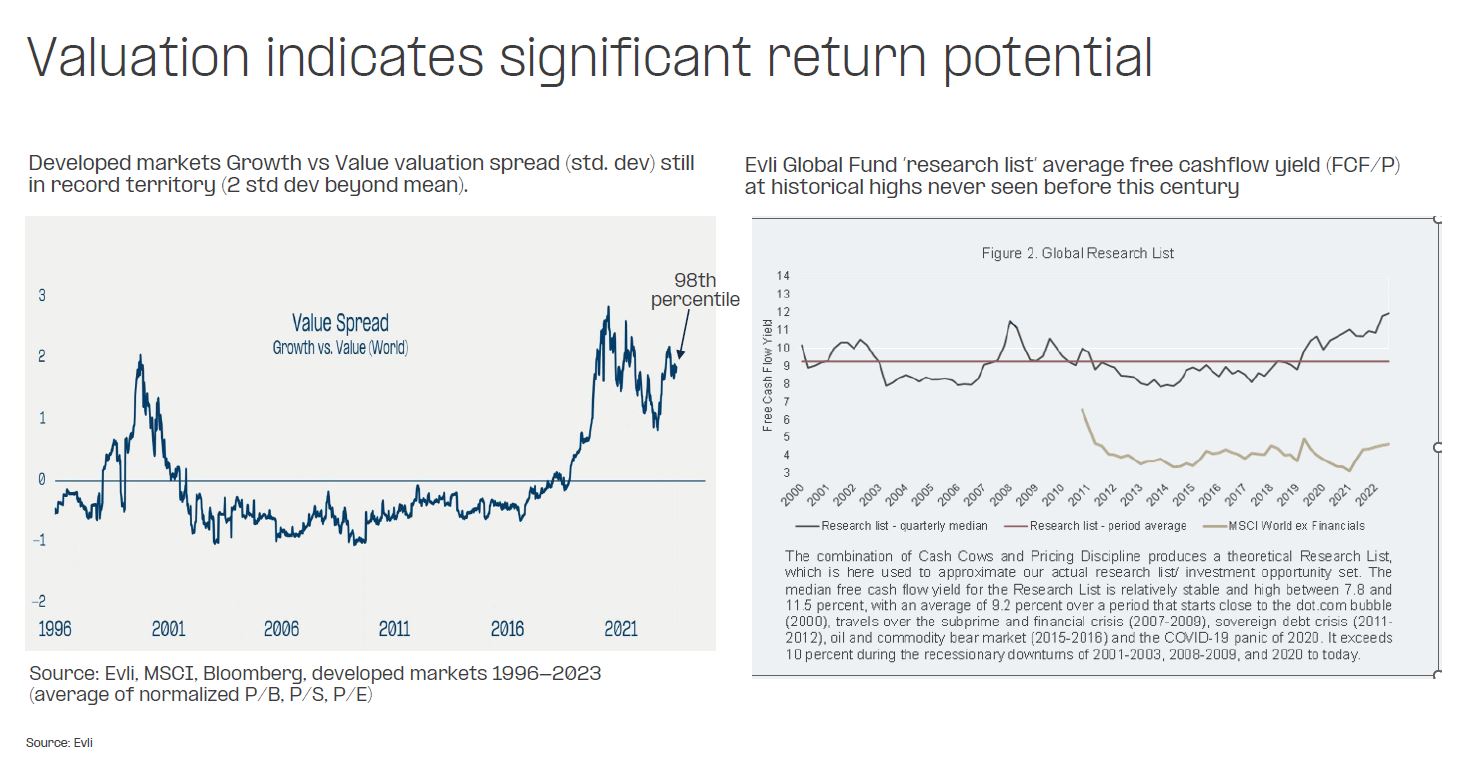

In addition to earnings, the most obvious driver in this cycle has been the interest rate level. The zero-rate policies ushered by the financial crisis of 2008 sustained a rally for growth equity worldwide for nearly 15 years. Clearly, the interest rate cycle trend changed again after supply-chain issues in the pandemic ignited inflation in 2020 and central banks started raising policy rates two years later coinciding with energy prices chocks brought on by War in Europe 2022. During this same timeframe value and valuation-orientated equity started outperforming its growthier cousin.

The decade-and-a-half devaluation of value equity has made it relatively cheaper than ever. The value bull is born on pessimism and grows on scepticism. We feel this is where we are now: coming to the end of detention, value equities being John Bender, the true heartthrob of the movie, declaring to his peers, “Sweets, you couldn’t ignore me if you tried!”

Market trend changes and low valuation levels

At the end of this blog post, you can find our Talking Points for January 2024. The document is Evli’s International Team’s outlook on the current opportunities in the market. This edition focuses on the opportunities in our Global Equities offering. Here are some exciting things to consider:

- The investment philosophy behind our funds, like Evli Global, Evli Europe, Evli GEM and Evli Nordic, is about valuation discipline. It’s not about buying the cheapest stocks on the market but buying the financially strong quality companies cheaply. The recent shift in the market cycle is playing right into the hands of our Global Equities family of funds. We’d like to wager that this trend will run for years.

- The portfolios of our Global Equity funds are trading near historic lows compared to their history or market averages. Or almost anything, in fact. Companies in Europe and GEM* funds offer average free cashflow yields of over 13% (P/FCF 7**). That’s a 50–70% discount to the market valuation and 25–35% below their historical average. These prices imply annual average returns of 15–20% over the following years, or however quickly historical averages take to revert to mean. However, the Vice Principal would like to remind you that past performance is not indicative of future returns.

- But it is not as if we need to make excuses for the difficult relative trading environment for valuation-oriented strategies in the past decade-and-a-half. Under the current strategy, Evli Europe has a lifetime track of beating its benchmark on average of 2.37% p.a. (since 2010) and 4 out of 5 last calendar years. Evli GEM has a lifetime alfa (since 2016) of 2.57% p.a. and just shy of 4.00% p.a. in the previous five years. Evli Global has exceeded its benchmark annually (since 2011) by almost 1.00% annually and more than 1.50% p.a. in the past three years. Getting the better of the Magnificent Seven*** has not been easy, but mission accomplished. All returns for the IB-series post full fees.

- Judging from these valuation levels, expectations are modest, certainly in Europe and the Nordics. Whilst the upcoming full-year results season with its 2024 outlook might not yield upgrades, we would argue caution is priced in, perhaps in exaggeration. With consensus on their toes – especially in Europe and the Nordics – investor expectations carry the most attractive feature you wish for: they are beatable! Hence, triggers for revaluation exist. With tangible evidence of market trend changes combined with low valuation levels (aka high potential returns), the price of inaction is far costlier than the cost of a mistake – everything you want in a successful investment.

Whilst relapses might occur (with periods of growth again outperforming value) even seemingly endless detentions eventually come to an end. We believe valuation-focused investors’ decade-and-a-half-long ordeal in the equity markets has turned from being held hostage by the high-growth momentum to enjoying the sweet returns their attractive valuations imply. The value equity is finally free, walking out of detention across the field, one fist held high.

Your Breakfast Club, aka Evli’s International Team

* GEM = Global Emerging Markets

** P/FCF = price to free cashflow

*** Magnificent 7 = Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla

See above slide and further in depth info about the opportunities in our Global Equities offering here.