Fed Chair Jerome Powell stated that inflation was still too high and that the Fed wants to see clearer signs of a continued downward trend. Inflation eased slightly in April, slowing from 3.5% to 3.4%.

Core inflation also slowed to 4.1% but is still far from the target level. Labor market tensions eased somewhat. The number of new jobs created in April was “only” 175,000, which was fewer than expected, and unemployment edged back up to 3.9%. The confidence indices for both manufacturing and services fell below the 50-point mark again. The Fed will continue to reduce its balance sheet and shrink its market purchases from USD 60 billion to USD 25 billion per month.

The outlook for inflation in the US is somewhat clouded by the economic policies of the US presidential candidates. Both Trump’s and Biden’s economic platforms are feared to be inflationary. There has been no substantial change in the electoral landscape, even though Trump was found guilty in a New York court on felony counts of falsifying business records. The verdict will be delivered on July 11, just before the Republican Party national convention on July 15. The candidates are also due to face each other in a televised debate on June 27.

Developments in the euro area mirrored those across the Atlantic. Industry’s assessment of the current situation weakened somewhat, but expectations rose slightly. In services, optimism increased. Inflation in Germany and France turned out to be slightly higher than expected. A cut in the European Central Bank’s refinancing rate on June 6 is now considered almost certain. Market attention is likely to be focused on Christine Lagarde’s comments regarding the outlook. However, market expectations about the pace and size of rate cuts have faded. The ECB is expected to reduce its refinancing rate two more times this year after the June meeting.

In the United States, long rates ended at around 0.1-0.15 percentage points lower, after dropping to more than 0.30 percentage points below the April figure. By contrast, German long-term interest rates rose by around 0.1 percentage points above their levels at the end of the previous month. Germany’s 10-year interest rate has risen by 0.66 percentage points since the turn of the year.

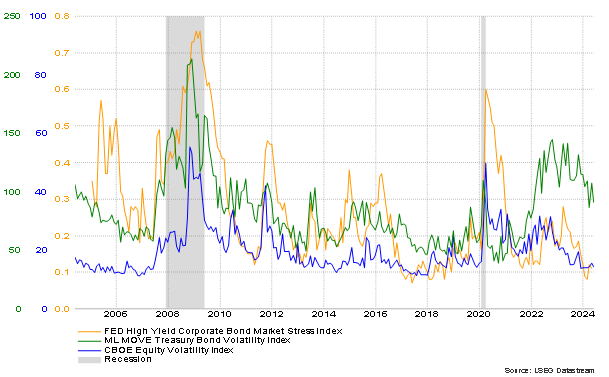

Equity and corporate bond markets were carefree

Equity market sentiment has remained strong and confident. Economists have generally been raising their economic forecasts, and analysts their earnings forecasts. Bloomberg’s consensus forecasts for corporate earnings for the current year are now 13% for the S&P 500, 8% for Stoxx 600 companies and 15% for MSCI Emerging Markets companies.

The equity market rally stalled towards the end of the month, however, as sentiment in the fixed income market weakened. The decline in corporate bond risk premiums nevertheless continued at a comfortable pace. The asset swap spread for the ICE BofA European Currency High Yield Constrained index narrowed to 271 points, the lowest level in three years. The lowest level in the last 10 years is 212 points.

Nordic and European equities rose 3% and North American equities 4% when measured in euros. Emerging market shares ended up 1% in the positive after a sharp upswing in China’s equity market as enthusiasm for the country’s real estate market support package waned. There was no change in Japanese equities.

Figure: Stress indicators for equity and fixed income markets on a downward trend