The situation in Ukraine was at the center of world politics in March. Negotiations between the United States and Russia produced a tenuous agreement on limiting military strikes by Russia and Ukraine. At the same time, the UK and France were putting together a coalition of European countries in support of Ukraine. A more permanent ceasefire still seems a long way off, however, given Russia’s strict demands.

Following Germany’s federal elections in February, a EUR 500 billion investment and defense spending package announced by chancellor-in-waiting Friedrich Merz catapulted euro area long-term interest rates up by 0.5 percentage points. A solution on a large defense package was reached before the new coalition government was formed and by easing Germany’s constitutional debt brake. A new government is yet to be formed and is likely to be made up of the Christian Democratic Union (CDU) and the Social Democrats (SDP).

Future tariffs weaken economic outlook

The European Central Bank cut its key interest rate to 2.5 percent at the beginning of the month. As global economic and market uncertainties increased, long-term interest rates also went on a decline toward the end of March. When the news broke on President Trump’s tariffs, central banks adopted a wait-and-see stance in their statements.

A trade war is anticipated to raise import prices not only in the US but also in the countries hit by the tariffs. It will also weaken the export prospects of the US’s trading partners and slow their economic growth. Among others, the OECD lowered its global growth forecast for the year ahead from 3.3 percent to 3.0 percent.

In the US, a rise in import prices could slow consumer demand and raise production prices. Nevertheless, the markets believe the US Fed will cut its policy rate again in June.

President Trump’s import tariffs come into force on April 2. Many of the US’s trading partners have threatened to announce retaliatory tariffs. Overall, the tariffs are expected to have a broad adverse impact on both final demand and prices.

In the US, consumer confidence weakened, and inflation expectations rose sharply. Industrial confidence, on the other hand, remained stable, at least for now, despite the rapidly changing operating environment.

Equity market stress grew

Increasing uncertainties also weighed on the equity markets. European equity markets enjoyed a temporary boost from the decisions made by Germany, but US President Trump’s 25 percent auto tariffs soured sentiment at the end of the month. The Stoxx Europe Index declined 4.2 percent, while the US S&P 500 Index declined 5.8 percent. The strengthening of the euro by over four percent further weakened euro-denominated performance.

Equity analysts have generally revised their earnings expectations downwards. S&P 500 companies are expected to report earnings growth of eight percent for the first quarter and growth ranging from 10–12 percent for the rest of the year. The early-year earnings of Stoxx 600 companies are anticipated to have declined by one and a half percent but should recover to the 8–10 percent level toward the end of the year.

There was an equity market rotation away from the largest companies. In Europe, LVMH and Novo Nordisk, previously the largest companies in terms of their market capitalization, were overtaken by the German software company SAP. In the US, the equity prices of the Magnificent 7 have fallen by 17 percent since the beginning of the year, and the S&P 500 Index was down 4.6 percent. Car manufacturer Tesla’s equity price plunged 35 percent due to a backlash against the antics of its largest shareholder Elon Musk. Many investors have reacted strongly to the situation and newsfeeds have driven market reactions.

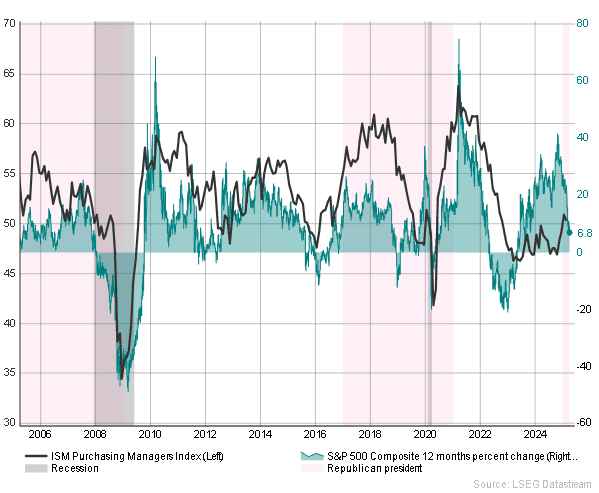

Figure: The US equity market rise slowed to 6.8 percent year-on-year and the PMI reading is slightly above 50 points