A rift was torn open between the US and Europe as the US and Russia moved closer over the negotiations on the war in Ukraine, European decision-makers were shocked by the Americans’ blunt statements and plans to put an end to the war. leading to breakdown of mutual trust within security policy.

The negotiations injected new momentum into reinforcing Europe’s defense, particularly arms procurement, personnel and logistics. Several countries are planning to boost their defense spending, but financing this will be a challenge as many of them already have high public debt.

Hopes for peace are fueling market expectations regarding the reconstruction of Ukraine, but there is still a long way to go before any projects can start, however, and crucially, Ukraine needs security guarantees that it can rely on. Part of the equation may be the minerals deal pushed by Trump, which would give the US rights to proceeds from the sale of raw materials. Otherwise, the Ukraine issue does not affect the US economy to the same extent it does Europe’s.

Trump shakes up US administration

Implementation of the executive orders issued by the President at a frenzied pace began in the United States. Staff were laid off in federal agencies and funding programs were discontinued. Many of these orders have been appealed in the courts and they may never be executed. Trump's policies have not yet had a strong negative impact on the US economy, which they are seen to benefit, despite everything. Still, US consumer confidence fell unexpectedly and more sharply than anticipated, according to a University of Michigan survey, wiping out the increase in optimism over the past year.

The markets were initially cautious about Trump’s actions when contradictory statements were made by the President and many others in the administration. Global stocks stumbled at the end of the month when Trump announced import tariffs on Canada, Mexico and China.

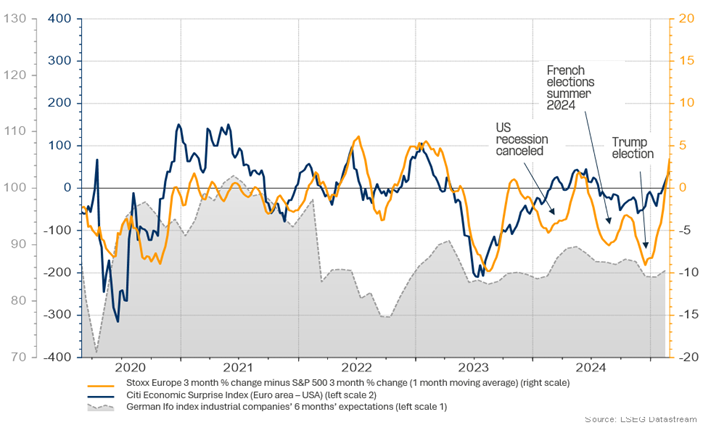

He also announced his intention to impose tariffs on European products as well. Tariffs are generally expected to push up import prices, which contributed to increased consumer caution. For example, retail giant Walmart warned of a slowdown in sales growth this year. In the US, equities fell by 1 percent. In the euro area, on the other hand, equity markets rose by 3 percent in February.

Massive data center investments planned

A flurry of huge investments in data centers were announced by major US tech companies. Amazon and Microsoft announced investments of USD 100 billion each, while Alphabet said it would invest USD 75 billion and Meta USD 50 billion. The total expenditure is greater than Finland's GDP.

The equity price of chipmaker Nvidia continued being volatile. Although the company reported higher-than-expected sales and profit growth in the fourth quarter and a strong outlook, its stock reacted negatively with an 8 percent decline following its profits report.

Market sentiment became substantially more cautious in the US and volatility rose. The yield on the US ten-year government bond fell by 0.34 percentage points despite the uncertainty over federal funding. The debt ceiling is approaching again and a solution is needed during March.

Figure: The euro area economy delivered a positive surprise and equity markets rose