Not often can an ordinary Dutch pension fund add a new asset class to its portfolio and enhance its key portfolio metrics. With Nordic Credit, ie. Nordic corporate bonds, however, this is possible.

regulatory framework is still important. In this current framework, an allocation to Nordic Unrated and Rated Credit (NURC) would impact the pension fund’s required capital (solvency buffers) as calculated by the so-called DNB S-Model.

Some pension funds have a high solvency ratio and are not constrained by the DNB S-Model, while for others the buffer requirements are a true constraint. For the latter group, the impact on required capital is an important variable when making the decision to invest in NURC. Basically – like an insurance company – these pension funds try to optimize the return on required capital.

Two alternatives for implementing an allocation to NURC

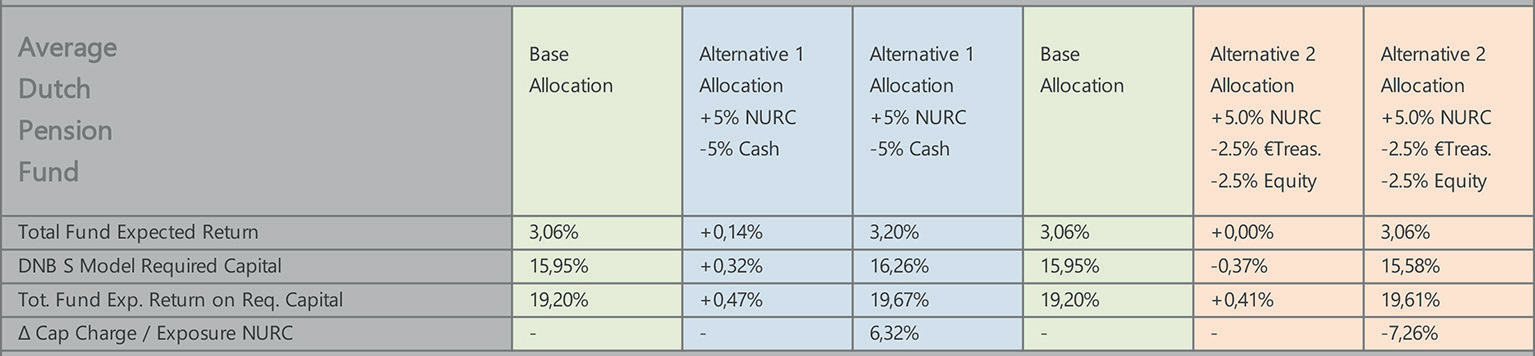

As a first step we investigate the regulatory repercussions of allocating to NURC. Analysing the impact from a regulatory perspective, we considered two alternatives for implementing a NURC allocation:

- Alternative 1: Fund a 5% allocation to NURC from cash.

- Alternative 2: Fund a 5% allocation to NURC from treasuries and equities denominated in euros – in a 50/50 ratio – while keeping the liabilities hedge ratio constant at 60%.

In the scenario of Alternative 1 – funding from cash – the total expected return for the typical pension fund goes up from 3.06% to 3.20%. The required capital though rises as well, from 15.95% to 16.26%. Because the total fund expected return rises sharper than the required capital, the return on required capital increases from 19.20% to 19.67%. This makes it interesting – from a regulatory perspective – to invest in NURC (funded by cash), since doing so improves the return on required capital.

Some pension funds might be extra constrained and therefore not eligible to raise the DNB S-Model required capital. When making investment decisions, they must always make sure the required capital does not increase. For these pension funds Alternative 2 – funding from treasuries and equities denominated in euros – is a possibility. In this alternative the expected return stays at 3.06% while the required capital goes down to 15.58%, implementing an increase in the return on required capital to 19.61%.

Looking at the two alternatives above, we can conclude that NURC is an interesting asset class from a regulatory perspective. One can increase the return on required capital by investing in NURC and, depending on the pension fund’s situation and appetite, one can choose to increase or decrease capital requirements.

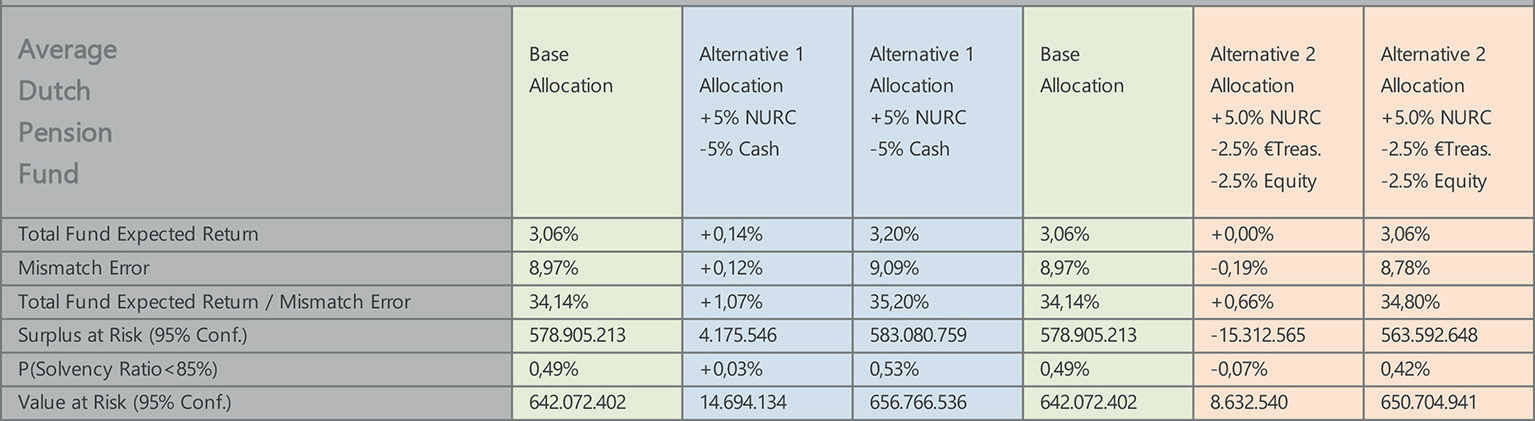

The impact on solvency risk and the expected return/solvency risk ratio

So far for the regulatory point of view. As a next step, we investigate the impact on solvency risk and the expected return/solvency risk ratio. Here, solvency risk is measured by the mismatch error which is the tracking error of the total pension fund’s assets versus its liabilities priced at the so called Dutch UFR discount curve. Also from this perspective, allocating to NURC can be fruitful.

Looking at Alternative 1 again – funding the NURC allocation from cash – the expected return goes up from 3.06% to 3.20%. The mismatch error increases from 8.97% to 9.09%. Since the expected return shows a sharper increase than the mismatch error, the expected return/mismatch error ratio goes up from 34.14% to 35.20%. Here, the 5% allocation to NURC funded from cash improves the expected return/solvency risk ratio, making it a sensible and efficient decision.

As discussed, Alternative 1 might not be possible for all pension funds because of regulation. Alternative 2 – funding NURC from treasuries and equities denominated in euros – is an option for all pension funds and keeps the total fund expected return equal while reducing mismatch error.

This results the expected return/mismatch error ratio to increase to 34.80%. Here again allocating to NURC is beneficial from a total return/solvency risk perspective.

Conclusion

Based on this case study, we can conclude that for a Dutch pension fund it’s certainly worthwhile to consider allocating to NURC. On the regulatory side one can improve the return/required capital ratio, while from a solvency risk point of view one can improve the return/solvency risk ratio.

Figure 1 and Figure 2 show the key findings for a typical Dutch pension fund. For most pension funds the findings will be similar, but these of course depend on the specific assets and liabilities of each fund.

Figure 1: DNB S-model implications for Nordic unrated & rated credits

Source: All calculations are provided by Van Stuijvenberg Financial Services.

Figure 2: Solvency risk implications for Nordic unrated & rated credits.

Source: All calculations are provided by Van Stuijvenberg Financial Services.

Summary

- Nordic credits are often officially unrated. That is why they offer higher return on similar credit risk.

- The Nordic credit market is short in duration by nature, providing interesting diversification alternatives.

- An ordinary Dutch pension fund can benefit from adding Nordic Credits to its portfolio from both a regulatory perspective and from a solvency risk point of view.

- On the regulatory side, the return/required capital ratio is improved and considering the solvency risk, the return/solvency risk ratio is improved.

By Juhamatti Pukka, Head of Fixed Income, Evli Fund Management Company, Jani Kurppa, Portfolio Manager, Evli Nordic Corporate Bond Fund, and Jan Willem van Stuijvenberg, Investment Consultant and Business Owner, Van Stuijvenberg Financial Services.

Original article published in Dutch magazine Financial Investigator issue 7, 2022.