Evli Fund Management Company Ltd has decided on a merger in which Evli Wealth Manager Fund (merging fund) will be merged with Evli Global Fund (acquiring fund).

The Financial Supervisory Authority granted permission to conduct the merger on March 30, 2023.

The merger will take place on May 12, 2023, at which time the merging fund will be dissolved without liquidation and its assets and liabilities will be transferred to the acquiring fund. No separate actions are required from unit holders to accept the merger and receive the fund units of the Evli Global Fund offered as merger consideration. Trading with the units of Evli Wealth Manager Fund will end at 2.00 pm (Finnish time, CET +1) on May 9, 2023.

Reasons for the merger

The merging fund is, as specified in its rules, a balance fund that can invest all its assets in either the equity or fixed income markets. The assets of the merging fund have mostly been invested in equities. The mutual funds participating in the merger invest their assets principally in equities and equity-linked securities without geographical restrictions. The mutual funds have a similar geographical focus, which justifies the merger of two funds with the same strategy into one fund as it will improve administrative efficiency and ensure a high standard of portfolio management. Unit holders of the merging fund will benefit from the merger through the larger size of the acquiring fund, which protects the continuity of the investment.

Evli Global invests its assets mainly in developed market equities and equity-linked securities, without geographical restrictions. Both funds are actively managed. Evli Global has the same risk class as the merging fund and the risks to the acquiring fund are similar to those of the merging fund. The acquiring fund promotes, in addition to other characteristics, environmental and social characteristics in accordance with Article 8 of the Sustainable Finance Disclosure Regulation. Evli Wealth Manager has only considered sustainability risks.

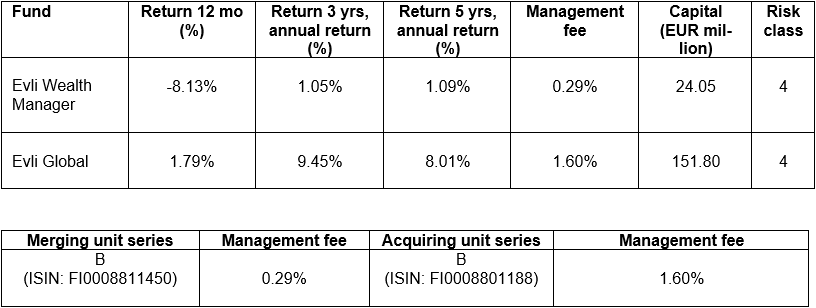

The fixed annual management fee of the merging fund is lower than that of the acquiring fund, which means that the management fee for unit holders accepting the merger consideration will increase.

Information on the funds involved in the merger on January 31, 2023

Consequences of the merger

Evli Wealth Manager Fund unit holders

Under the Act on Common Funds, a unit holder of the merging fund will become a unit holder of the acquiring fund on the merger date, unless the unit holder redeems their fund units or switches them to units of another fund managed by Evli Fund Management Company Ltd before execution of the merger.

The holdings of unit holders who accept the merger will be converted by the Management Company to holdings in the acquiring fund of corresponding cash value on the basis of the values of the fund units calculated on the merger date. The merging fund only has a single unit series, unit series B (growth unit), and unit holders will receive Evli Global B series (growth unit) units as merger consideration.

The unit holders’ rights in the acquiring fund will enter into force when the units received as merger consideration have been entered in the unit register maintained by the Management Company. Technical registration of the fund units received as merger consideration will be carried out by May 19, 2023, using the fund unit values confirmed for the merger date.

The Management Company can convert the assets of the merging fund into cash immediately before the merger date to ensure an uninterrupted merger. Changes to investment weightings and investment instruments can also be made to the fund before the merger. Any accrued income of the fund, such as sale price receivables for sold securities or accrued interest, will be taken into consideration as assets of the merging fund and will be transferred to the acquiring fund in the merger.

The Management Company will not charge redemption or switch fees from those unit holders who wish to redeem or switch their fund units before the execution of the merger. The deadline for placing redemption or switch orders is May 9, 2023, at 2.00 pm (Finnish time, CET +1). Any orders received after this time will be executed after the completion of the merger. For redemption requests submitted by the deadline, redemption proceeds will be paid in cash to the unit holder’s cash assets held at Evli Plc by May 19, 2023.

Evli Global unit holders

The merger is not expected to have a significant impact on the unit holders of the fund and it does not affect their rights. There will be no changes to the rules of the acquiring fund, and the composition of the investment portfolio will not change significantly but its assets will grow by the amount of the capital transferred in the merger. The assets of the merging fund will be transferred either as cash or as securities or a combination thereof and the acquiring fund will continue to manage them in accordance with its investment strategy.

Taxation

Unit holders are encouraged to seek advice from professional advisers, if necessary, on the statutory implications of the merger on law, finances and taxation in the unit holder’s country of domicile, residence or location of the unit holder. If a unit holder resident in Finland for purposes of taxation accepts the merger consideration offered in the form of fund units, there will be no tax consequences since this constitutes universal succession as referred to in Finnish tax legislation. However, redemption of fund units or switches to another mutual fund executed before the merger are subject to taxation in the same way as any other sale (or exchange) of property, i.e. normal tax treatment will be accorded to any such transfer of fund units. Correspondingly, any sale of the new units received as merger consideration will be taxed normally after the merger. However, the acquisition cost of the new units will be considered to be equal to the acquisition cost of the old units held in the merging fund.

Additional information

The key investor information document, fund prospectus and fund rules of the acquiring fund and the semi-annual reviews and annual reviews are available at www.evli.com/funds. Unit holders of the merging fund are recommended to consult the documentation of the acquiring fund. Unit holders of the merging and acquiring funds are entitled to receive a copy of the report concerning the merger issued by the auditor appointed by the Management Company. The report is available from Evli Fund Management Company Ltd.

Our Investor Service will gladly provide additional information on the merger or other matters relating to fund investment by telephone, +358 (0)9 4766 9701, or by e-mail at info@evli.com from Monday to Friday from 9.30 am to 16.30 pm (Finnish time, CET +1).

EVLI FUND MANAGEMENT COMPANY LTD