In May, the Evli Emerging Frontier team continued our 11 Sectors in 11 Months project, meeting 176 companies from 29 countries, mainly from the Infrastructure sector which includes the real estate industry. We learned that most residential developers expect significant earnings growth this year not only because postponed 2020 projects will be recognized as revenue in 2021, but also thanks to overwhelming demand for new properties driven by record-low mortgage rates.

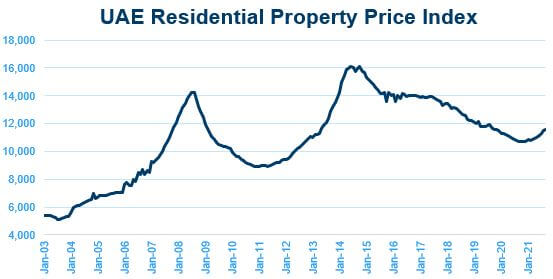

Dubai property prices on the rise

Being based in Dubai has proven useful to us mostly thanks to the city’s great connectivity to other emerging markets. However, this year it has provided an extra edge as we dove deep into the local housing market, which after a six-year decline of nearly 40% has seen property price growth in the last several months, a promising sign that it might have bottomed out. In fact, having experienced first-hand the plateaued dirt-cheap rental rates, we now witnessed a beginning of market recovery by touring several properties and speaking with dozens of brokers. Dubai’s highly efficient management of the pandemic with the second-highest Covid vaccination rate in the world as well as the Expo-2020 and relaxed lending standards should serve as additional catalysts bringing residents and real estate investors to this market. To capture this trend in our portfolio, we bought shares in the highest-quality listed developer in Dubai trading at less than 8x P/E.

Source: Bloomberg

Warehousing demand skyrockets as e-commerce takes flight

A strong trend we heard about repeatedly is the acceleration of e-commerce market share gains at the expense of brick-and-mortar businesses as people have been doing much more online shopping during the pandemic. This has severely impaired the values of many retail real estate operators and contributed to soaring values of e-commerce players. While the multiples of darlings such as MercadoLibre (the “Amazon.com of Latin America”) are far too rich for our blood (2,800x its record LTM earnings and even 14x sales), we came across a $600m Brazilian commercial real estate developer which benefits from the growth of e-commerce companies by leasing warehouses to them (it’s even onboarding Amazon soon). The CEO is highly upbeat about the future prospects and expects 3-4x earnings growth this year, while the company trades at only 13x LTM P/E multiple.

.png)

Meeting with a $600m Brazilian commercial real estate developer

Strong earnings growth in portfolio holdings thanks to US housing boom

Our existing positions in the Colombian glass manufacturer and Indonesian building materials and furniture manufacturer are benefiting greatly from the booming US real estate market. The glass maker has orders fully booked for the rest of the year and has already revised its earnings guidance upwards twice this year, and the backlog of the furniture maker continues hitting new highs every quarter. Both stocks have more than doubled since we bought them.

Learn more about our Evli Emerging Frontier Fund

Our recent blogs in the "11 Sectors in 11 Months" series

A month focused on technology: Chip shortage drives demand and earnings during the pandemic

A month focused on consumer goods: Pandemic boosts Indonesian furniture and Colombian windows

A month focused on commodities: Buying a coal company that doesn't produce coal