Is it still possible to find reasonably priced stocks? Yes, if you choose your hunting ground wisely, says Hans-Kristian Sjöholm from our Global Equities team.

This is the first blog in a new series, in which we dive into the strategy and daily life of Evli’s Global Equities team. The Global Equities team invests in underpriced companies that generate cash flow and have strong debt coverage.

Much is written about the stock market’s high valuation. A widely followed columnist summarized the discussion about U.S. equities succinctly in a Bloomberg article last December: “They look extremely expensive by almost any measure that compares them with their own sales, dividends, earnings or cash flow.”

Some ask whether it’s still possible to find reasonably priced stocks within the universe of companies that we are interested in.

Searching for undervalued cash cows

The world is a big place. To narrow it down, we use a screen that evaluates a company’s past ability to generate cash over the short- and long-term as well as the capital structure supporting that ability going forward. In developed stock markets, we’re talking about a thousand companies a.k.a. “cash cows”.

Within communication services, Publicis and Facebook are cash cows. In the UK, Sage Group and Bunzl are cash cows. Within large caps, Amazon, Microsoft, Apple, and Cisco are cash cows.

Our mantra is “find free cash flow and do not overpay”. If you compare free cash flow to the price paid, some stocks appear underpriced, some fairly priced and others overpriced. While controlling for growth and quality, we much prefer moderately priced stocks. Sure, some ‘expensives’ will keep on giving, but systematically paying high prices on a group basis is dangerous. Instead, we hunt relatively undervalued cash cows.

Your hunting ground matters

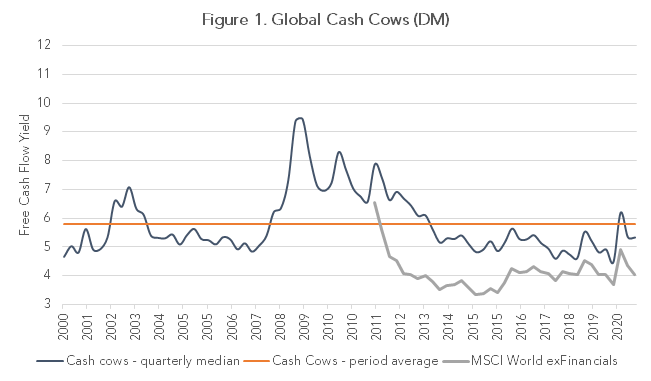

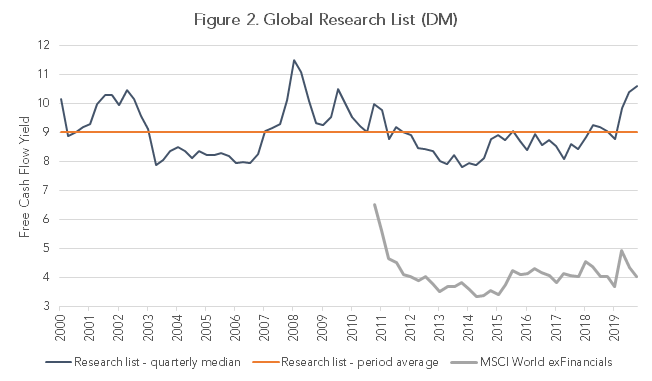

Sources and data: Bloomberg, Evli Global Equities.

Figure 1 above shows the median free cash flow yield for the global universe of cash cows between 2000 and 2020 (developed markets). It varies quite wildly between 4.5 - 9.5 per cent and tops at 9.5 during the 2008-2009 financial crisis. At Sept 30, 2020 it stood at 5.3 per cent, close to its average.

Our hunting ground is denoted “Research List” and it is shown in Figure 2. The free cash flow yield is relatively stable and high between 7.8 and 11.5 per cent, with an average of 9.0 percent over a period that starts close to the dot.com bubble (2000), travels over the subprime and financial crisis (2007-2009), sovereign debt crisis (2011-2012), oil and commodity bear market (2015-2016) and the COVID-19 panic of 2020.

It only exceeds 10 per cent during the recessionary downturns of 2001-2003, 2008-2009, and 2020! We’re no fans of market timing, and we strongly advise against short-term trading of our mutual funds, but from the perspective of our investment strategy, today seems like a decent entry point for long-term unitholders.

Interested in learning more? Watch this video about the investment strategy of our Global Equities funds: Back to the Basics of Investing >