Every year, a good 35 billion tonnes of carbon dioxide are emitted worldwide. In order to mitigate the impact on the global climate, investors are primarily looking for forest assets that are in line with net zero and sustainability targets. Previously classified as a rather boring asset class, forests are now experiencing a renaissance among globally minded investors.

Long-term asset preservation over 60 years

Forests have always been valued by traditional investors for their capital preservation and diversification benefits. Now they are also in demand for their ability to absorb carbon dioxide emissions. Investors can achieve a good return and fight climate change.

A historical analysis of the returns from an investment in forestry proves the point: In every decade since 1960, the increase in the value of US forestry has always exceeded inflation over the same period and by at least 2.5 percent. This effect was particularly pronounced in the 1980s, at a time when central banks were fighting high inflation rates with sharp interest rate hikes.

Tying up capital for 10 to 15 years initially acts as a disincentive. In an environment of permanently elevated inflation, however, patience pays off in the long run. The most common way to invest in forests is through direct ownership or through forest funds. Direct ownership offers investors greater flexibility to manage according to their own needs, but if very large sums cannot be invested, important aspects of a strategic investment such as profitability and diversification suffer. In a forest fund, on the other hand, capital can be pooled and invested in a larger portfolio.

Forest returns uncorrelated to capital markets

Outsourcing forest management to experts also reduces the risk of loss of value from fire damage or pests. Where forest is managed as an investment, significantly less damage occurs than in public forests. Fire breaks and dedicated teams of fire fighters protect the value of the trees. Forestation with pest- and drought-resistant species helps to survive periods of low rainfall.

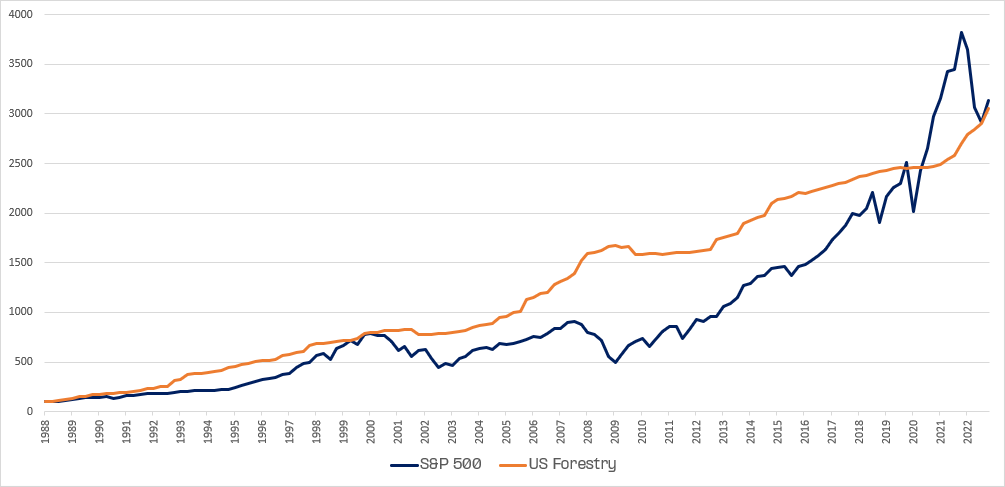

Financially, investors are rewarded with an attractive risk-return ratio. The US NCREIF Timberland Property Index is the commonly used benchmark for measuring the performance of forest investments. Over thirty years, the index recorded an average annual increase in value of between 8 and 9 percent with an average volatility of almost 9 percent.

By contrast, an investment in US equities yielded a little over 10 per cent per year. However, the average volatility was 17 per cent annually. Forest as an asset class thus has a significantly better Sharpe ratio than the world's largest and best performing stock market, as the performance of both asset classes in the chart shows.

Source: Bloomberg. US forestry has demonstrated stable returns and lower volatility than equities.

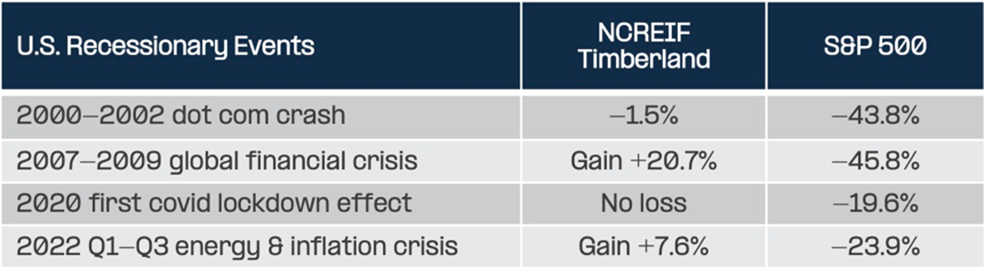

Even during the critical market phases of the 2000s, investors were in sound financial conditions with an exposure to the forestry sector. Forestry offers the unique opportunity to defer logging during weak market conditions while benefiting from the volume growth of trees. This growth is an important component of return and is completely detached from the capital market environment. Rising timber prices and land appreciation are the other return drivers.

US forestry preserved capital very effectively during recessionary events.

Risk, return and carbon intensity

Growth rates in Latin America, Australasia and even the USA are significantly higher than in Europe, especially in Scandinavia. Since almost two-thirds of a forest portfolio's returns come from the biological growth of trees, investors need to think globally to invest effectively in forests.

Tree growth brings another positive component: a fast-growing forest is more effective at capturing carbon. There are 4 billion hectares of forest on Earth, which significantly improves the planet's greenhouse gas balance. It is estimated that forests neutralise one third of the carbon dioxide released by burning fossil fuels every year. The path to a Net Zero economy therefore literally leads into the forest.

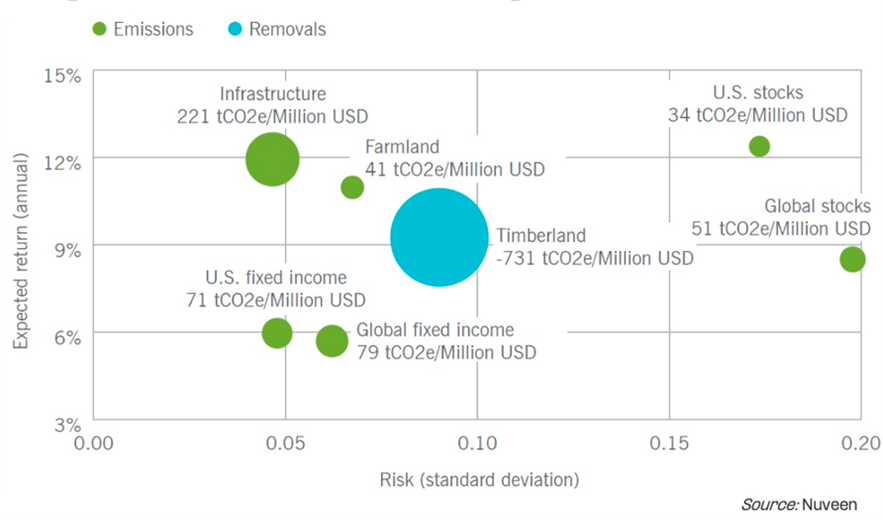

The chart illustrates the contribution that forestry can make compared to other asset classes according to estimated average risk-return and carbon intensity values. Targeted reforestation and the planting of new forests in fast-growing, warm and high-precipitation regions of New Zealand, Australia or Latin America has the greatest effect. Resulting potential risks of other jurisdictions can be mitigated by a fund structure that is compliant in the home market.

Over the last 30-years, forestry has provided a similar return to a global equity portfolio, but at a lower level of risk - towards that of fixed income. In addition, forestry is becoming increasingly valued for its sustainability characteristics. In a portfolio comprising asset classes that cause carbon emissions, the addition of forestry can lower the carbon footprint, due to forestry’s ability to remove atmospheric carbon.

Appreciation potential from CO2 certificates

The total value of commercially managed forests is estimated at 300 to 400 billion dollars globally. About 100 billion of this is owned by institutional investors, the rest by forestry companies, private individuals and municipalities. This valuation does not yet take into account the new opportunities for forest owners to be issued carbon credits for the amount of carbon absorbed. The trading of such certificates adds a new component to the potential return on an investment in forests.

The asset class could be worth up to a trillion dollars if CO2 markets and prices continue to develop as they have so far. However, confidence in carbon offset certification has suffered from recent news reports questioning their value. Credits for avoided emissions are usually generated by REDD+ (Reducing Emissions from Deforestation and Degradation) projects in developing countries. These are the most controversial. They are based on the assumption that a forest is at risk of being lost and that by setting up a REDD+ project one can protect the forest and avoid emitting the stored carbon. However, these are only hypotheses on the basis of which the threats may be overestimated and not occur or only occur to a lesser extent, so that the number of credits issued and sold is overestimated.

What is the point with CO2 certificates?

For certificates based on carbon removal, the focus is on eliminating carbon already emitted from the atmosphere. In these cases, the change in the volume of wood is physically measurable, so you can convert the increase into a corresponding volume of carbon. This way, investors can be sure that the carbon credit they bought actually has value and has removed carbon dioxide from the atmosphere.

In a carbon accounting approach, the change in stock of carbon removed from the atmosphere and stored in standing forests and harvested wood products is recorded annually. To have a real climate impact, sustainable forest management must be demonstrated, ensuring a sustainable supply of environmentally friendly wood products. While the carbon market can offer an additional revenue option and the potential for enhanced performance, a strategic investment in forestry should start where there are good natural growing conditions. This is especially true in North and South America.

Forest areas that have a low timber value but a higher carbon value could be developed into a carbon project. The resulting carbon credits can be an additional source of revenue, and the forest value thereby upgraded. In any case, an investment in forest helps to absorb carbon on a net basis. This is dynamically driving the current demand for assets that measurably reduce CO2. The current market environment fulfils the essential prerequisites for forest investments to become a megatrend.