After a slump, Nordic equity returns are set for a comeback.

In Norse mythology, Thor, the god of Thunder and the son of Odin rides the sky and wields his famous hammer, Mjölnir, for the good and protection of mankind. In short, he ensures the success of the North.

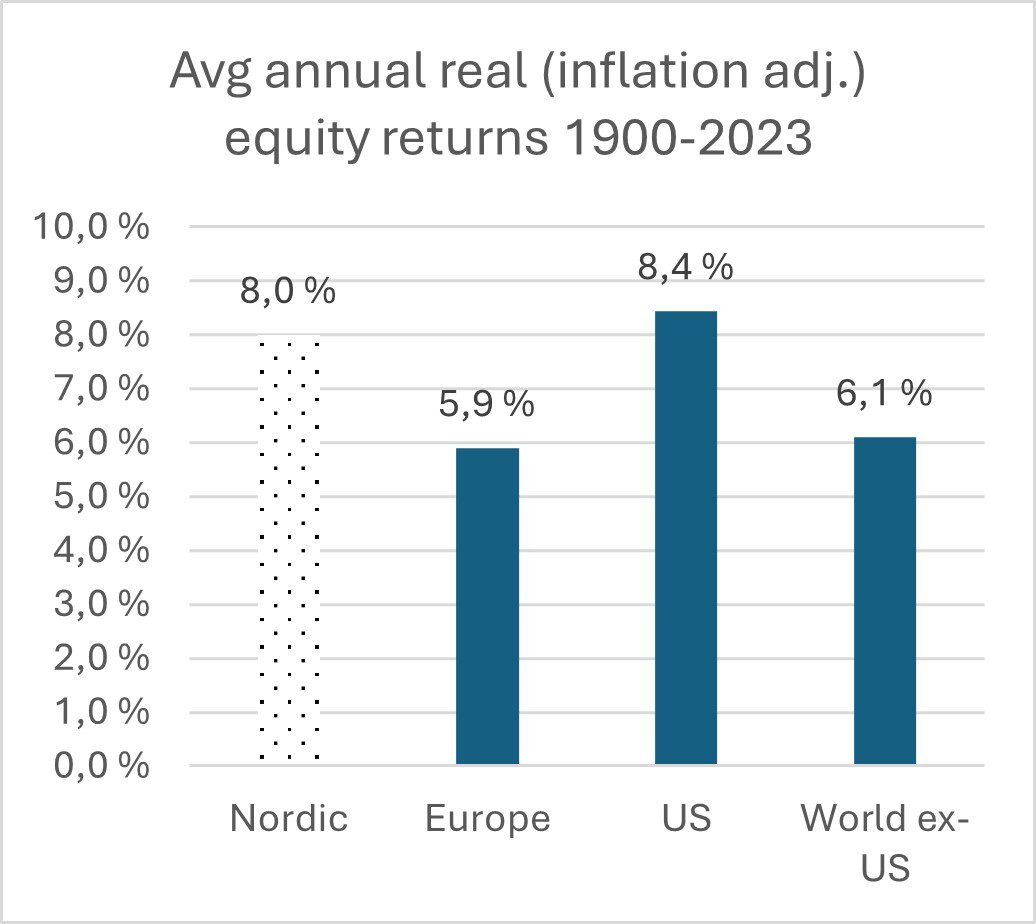

And success, whether it’s due to the god of Thunder or other, more down-to-earth factors, has been the name of the game in the Nordics. For eternity (read: the last 100+ years), the North has prospered, and Nordic risk markets, particularly equities, have excelled, outperforming any other region globally.

Source: UBS Yearbook 2023, Evli

However, trouble has been brewing. The progress has been less flattering for the past two to three years, with GDP growth placid or even negative at times. Investors and consumers alike have suffered from inflation, and many have burned their fingers on levered real estate projects.

It seems that Thor lost his hammer and what once was no longer applies. Can he get his hammer back? Is the world-beating 8% p.a. real return on Nordic equity returning, or is it just a thing of the past, destined to be remembered only as part of the local mythology?

Recovering mojo

According to legend, Thor woke up one morning to find his hammer gone. He asked Loki, the trickster god (and not his brother, despite what Marvel wants you to think) to help. It turned out that Mjölnir was stolen by Thrym, the king of the frost giants.

In an audacious move, Thrym demanded to marry Freya, the goddess of love, in exchange for returning the hammer. Thor and Loki devised a plan to disguise Thor as the bride-to-be and traveled to the wedding to reclaim the hammer. King Thrym, beside himself that he would marry Freya, organized a great feast and was quite taken aback by how much his bride could eat and drink. Loki, dressed as Thor’s bridesmaid, said that Freya hadn’t eaten for eight days as she was so eager for the wedding. The king then decided it was time for them to get married right then and there. He called for the hammer to be brought so they could exchange wows. When Thor saw his hammer, he jumped up, shed his disguise, grabbed Mjölnir, and laid waste on Trym and his frost giants.

The moral of the story? The Norse – especially Thor – will do anything to recover their mojo. What was squandered can be reclaimed.

The same can be said about the Nordic region. The 10th largest economy in the world reached its economic trough some six months ago, turned around with momentum and is now back on the growth path.

The export competitiveness boost from the record weak currencies of Sweden and Norway is now providing rocket fuel for the overall economy. In addition, domestic economies are recovering, supported by the stabilization of the real estate markets following a turn lower in the real estate cycle. The stage is set for corporate earnings growth and, hence, equity outperformance.

Back to world-class returns

At the end of this blog post, you can find our Talking Points for Summer 2024. The document is Evli's International Team's outlook on the current opportunities in the market. This edition focuses on the opportunities Nordic equities can offer. Here are some rather convincing points to consider:

- Over the longer term, Nordic equity returns have been world-class, rivalled only by the US. Nordic societies are orderly, productive democracies with highly educated populations innovating sustainably and catering to global markets, which makes the corporate environment nearly optimal. On top of this –or because of it?– government finances are steady with little debt, workforce employment is nearly full, and inflation is stable. No wonder Nordic equity risk pays off.

- Because of the cyclical nature of the open export-based economies, the premium Nordic equity returns have, over time, come with some volatility. While the excess return over European or Global equities (some +200bps per annum historically) more than compensates for that, more importantly, it provides lucrative entry points for opportunistic investors during market downswings, such as during the past two years.

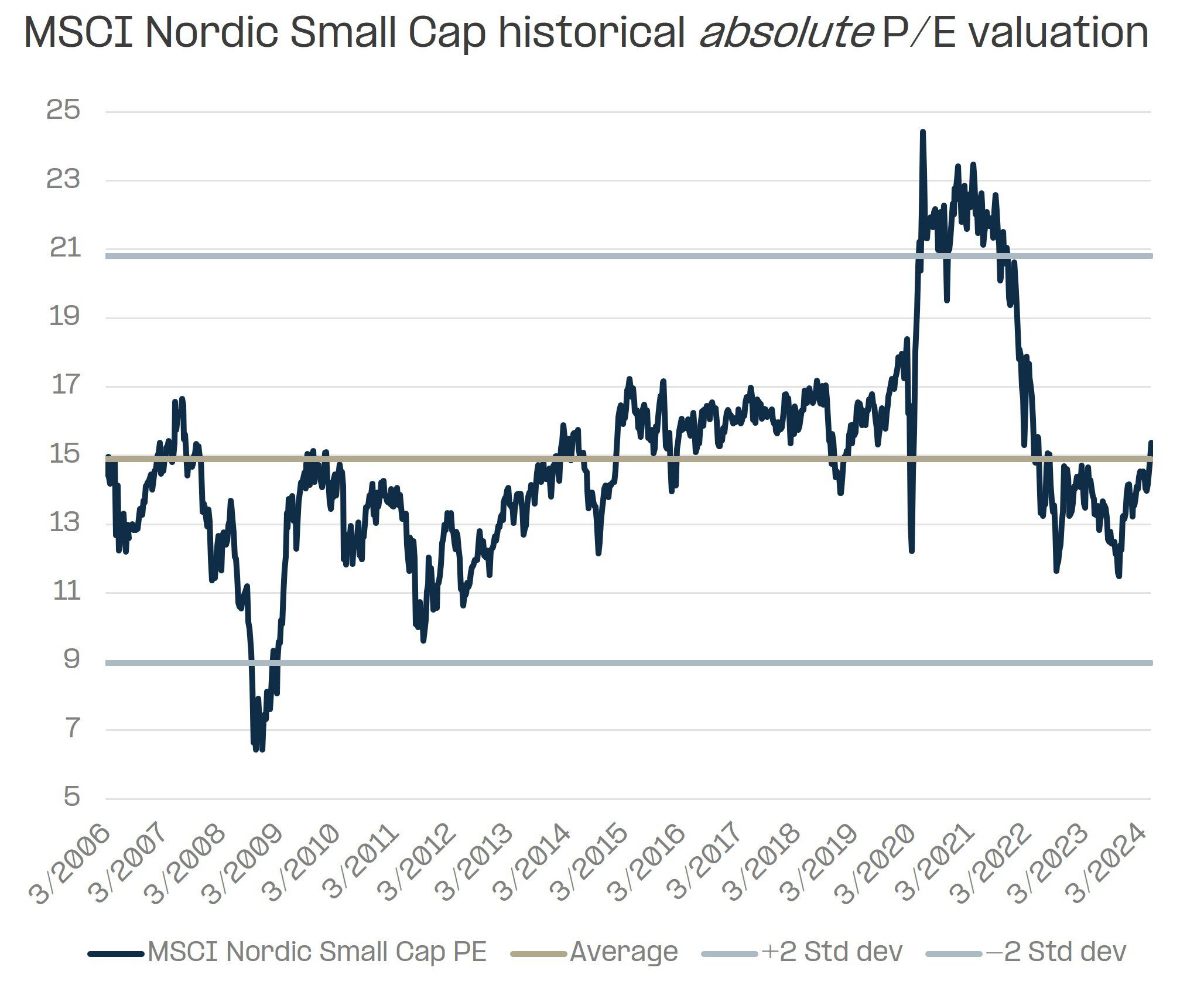

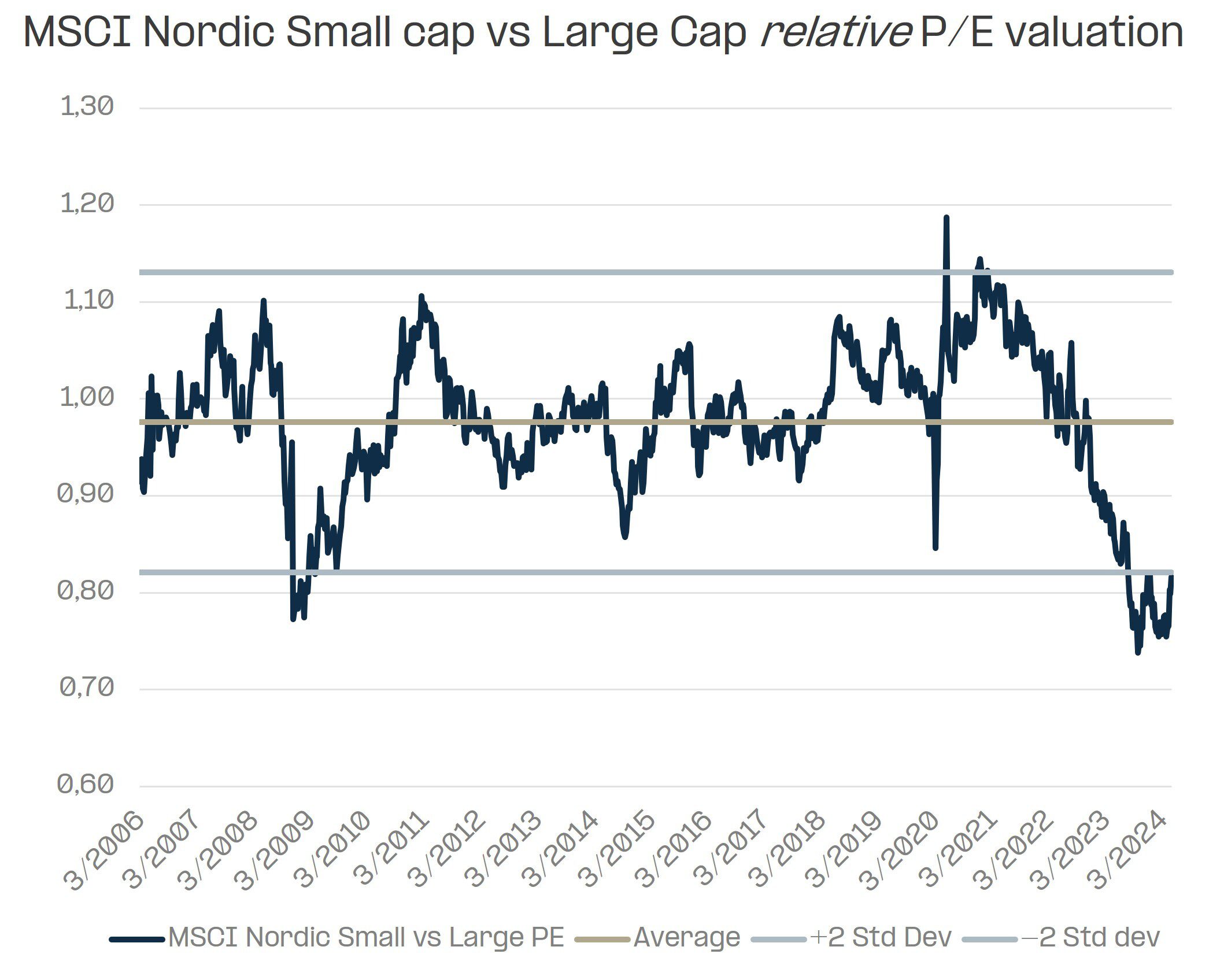

- While Nordic large caps have kept up with their European peers in the current cycle, small caps have not. Nordic small caps trade on par with their long-term historical average (P/E 15x), but relative to the large cap indices, they look cheaper than almost ever, sitting two standard deviations below the long-term average. That implies a +25% immediate upside relative to large caps just to get to where the average relation has been.

Graph sources: Bloomberg

- If Nordic all cap equity excels in global comparison, Nordic small caps have historically been outstanding sources of absolute and relative return. Witness the double-digit long-term track record (1,5, 10 years) of Evli Swedish Small Cap B (FI0008813142) and Evli Finnish Small Cap B (FI0008804422), the predecessors of the more recent Evli Nordic Small Cap IB (FI4000532536), which is based on the same philosophy and run by the same team.

Whilst past returns do not guarantee future ones the timing is opportune for the alert investor. We have exited two years of underperformance and are back on the long-term double-digit return trail – with some room to run.

Thor returned to Asgard with his hammer and got back to restoring order and prosperity. Nordic equity returns look set to regain their historical glory and we recommend every investor to ride the skies with them.

Read more in depth info about the positive Nordic economic environment here.

From Asgard, with love,

Evli's International Team