Despite the challenges, the timing is excellent for starting a Nordic position or adding to an existing one.

“Winter is coming” was the motto of House Stark in the smash hit series The Game of Thrones. Not only a catchy, ominous tagline, the motto served as a reminder for the people in the North that difficult times were ahead.

In the real-life North, winter indeed came with some formidable enemies. We fought the Army of the Dead in 2022, as inflation rose from the grave, and protected the wall in 2023, when central bank rates rose like ladders towards the sky. But now it’s evident that the North prevailed.

Towards the end of last year, naysayers were greatly concerned for the Nordics, especially the Swedish real estate market and even the Nordic economies. Those who pass the sentence should swing the sword, but heads have not rolled. Now, the downbeat Swedish real estate stocks (OMX Sthlm Real Estate) have rallied some 30% from their lows, the weak Swedish currency is up 5% against the Euro in the past three months, and Nordic stock indices have jumped more than 10% from their October nadirs.

Is this rise just the last feeble attempt of the slain King in the North? We think not. These are the green shoots of economic recovery fuelled by expectations of lower rates, declining inflation (i.e. rising real incomes), and export recovery.

Opportunities everywhere

It’s still early in the cycle, which has many implications. The traditionally cyclical economies in the North suffer in the downturn but equally prosper and provide strong returns in the upturn. Having seen the downcycle play out, opportunities are now everywhere, but especially in fixed income and credit.

At the bottom of this blog post, you can find our Talking Points for December–January. The document is Evli’s International Team’s outlook on the current opportunities in the Nordic markets. In this edition, we have focused on fixed income and credit, where the risk/return profile is still superior. Here are some key findings:

- The headline news flow of 2023 would have chilled anyone’s blood. War and geopolitical worries globally, megabank failures in Europe and the US, real estate woes in our backyard, and (up until very recently) aggressive inflation-fighting central banks. Anybody with the gift of foresight a year ago would have stayed well clear. Many did and risked missing the opportunity of a decade.

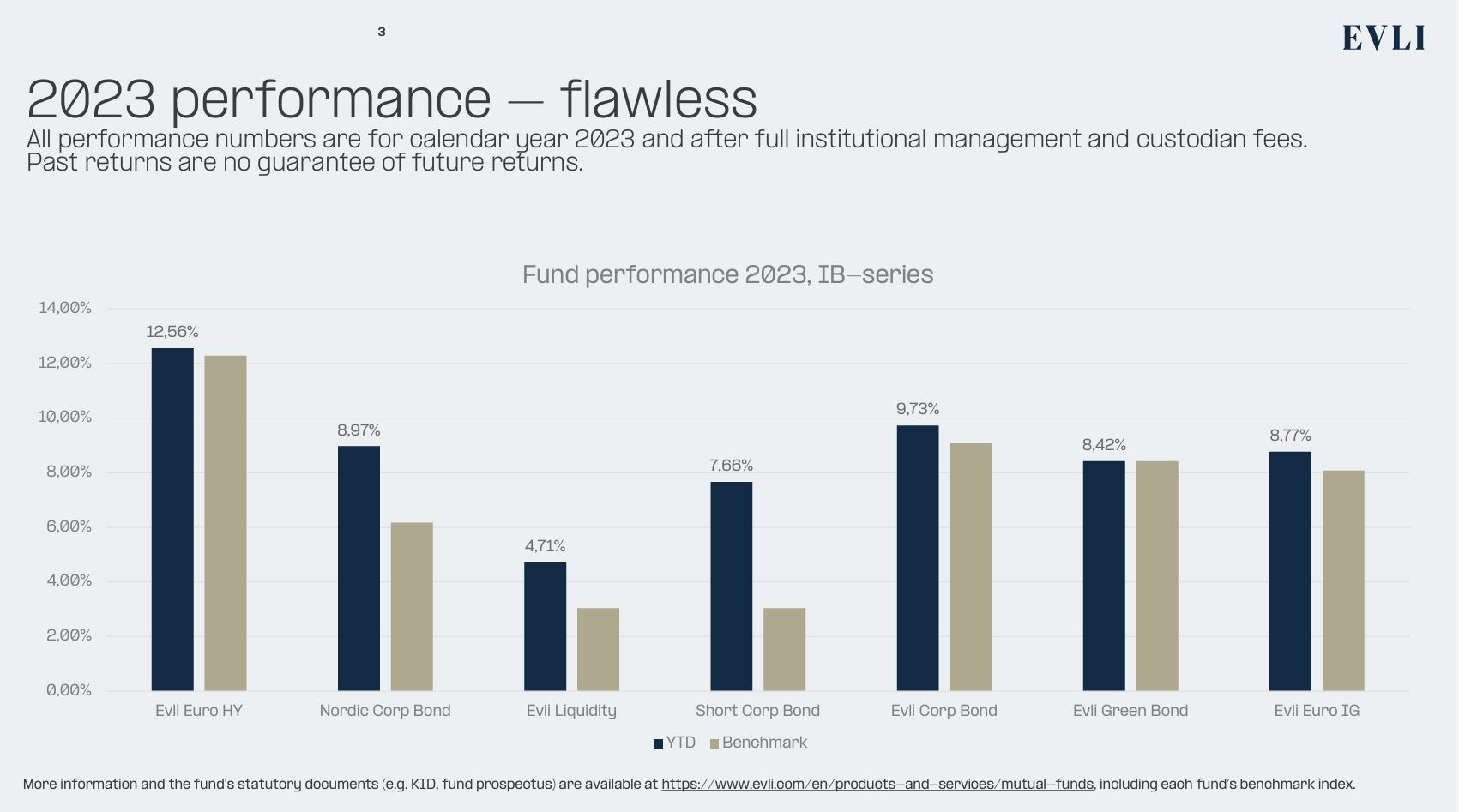

- The Evli credit funds posted a benchmark beating 7–12% returns, with the shorter-duration products producing slightly less than that. When risk-adjusted, this beats anything out there at the moment, excluding the high-flying US tech sector. But there is good news for those on the side lines; most of the journey is ahead of us. But make haste – it is always much nicer to travel than to arrive.

- The rock-solid fixed income returns of 2023 mostly originated (approx. 75%) from the good carry (YTMs of 5–8%) at the start of the period. The rest stemmed from some spread compression and pull to par/lack of credit events. We have come to expect this as the normal return contributors in Evli’s fixed-income funds. But as the Three-Eyed Raven would say: The deeds of yore do not foretell the fate of the morrow. In our parlance: past performance is not a guarantee of future performance.

- The return outlook for 2024 is equally solid. Corporate spreads (especially IG, crossover, and Nordic) remain elevated compared to their history. There is potential for further compression as Nordic company fundamentals improve, especially in the export industry. With average bond prices in the funds in their mid-90s, the returns to par (especially in the short-duration products) are pretty much ensured. Should the interest rate level decline in response to lower inflation, duration will add to performance. In a nutshell – the 2024 return outlook is a repeat of 2023.

The winter came, but the North has shown its strength. The timing is great for starting a new position or adding to an existing one – but keeping in mind that an unexpected, shocking plot twist could be right around the corner.

Your House Stark, aka Evli’s International Team

See above slide and further in depth info about fixed income and credit in the Nordics here.