Donald Trump claimed a clear victory in the US presidential election. The Republicans also won control of both the Senate and the House. The victory means we can now expect a continuation of the policies from Trump’s previous term.

American businesses are expected to benefit from Trump’s coming term, and this was reflected in equity market reactions after his election victory. Equity prices rose sharply in the US: The S&P 500 Index rose by five percent and the Russell 2000 Index by ten percent in November. US bank and energy company stocks were the best performers.

Trump’s Cabinet and senior staff nominations have offered a taster of what is to come. During his second presidential term Trump plans to significantly overhaul US trade policy, taxation, immigration and business regulation, among other things. International cooperation and US monetary policy implementation could also be in the firing line.

Trump’s economic policy is expected to maintain the federal budget deficit and continue the increase in national debt. However, the appointment of hedge fund manager Scott Bessent reassured markets, and the sharp rise in US long rates in October turned into a slight decline in November. The Fed is expected to cut rates again at its meeting in December, although several members of the Board of Governors have recently been more cautious in their views.

European and emerging markets were in negative territory or at zero. Trump’s announcement to raise import tariffs on China, Mexico and Canada immediately in January raised concerns about the impact on consumer prices in the US.

Europe’s outlook darkened

In addition to the US’s attitude towards Europe becoming more critical, the outlook was also darkened by domestic policy problems in Germany and France. Germany’s government collapsed and in France the budget debate is threatening to bring down the government. The euro weakened by about three percent against the dollar. Industrial sector confidence weakened again in the euro area, which raised new hopes for a half percentage point cut by the European Central Bank at its December meeting. The ECB is, however, more likely to stick with rate cuts of 0.25 percentage points.

The deteriorating outlook clearly suppressed long-term interest rates in the euro area. German and Italian 10-year yields fell by around 0.3 percentage points, leaving France behind. The yield spread between French and German 10-year bonds widened to 0.83 percentage points, which is the greatest it has been since the euro crisis in 2012.

Geopolitical tensions grew on the frontlines of Ukraine. North Korean troops joined the combat on Russia’s side, and Ukraine was given the green light to use long-range missiles by the US and the UK. Ukraine’s deteriorating position is increasing pressure for negotiations, but hopes for a lasting peace are low.

Our baseline scenario for 2025

Global economic growth will remain at its current rate in 2025. US economic growth will weaken somewhat, but the country will not enter a recession. Slow economic growth will continue in China and Europe. Inflation will continue to fall globally. The fall in inflation will make monetary policy easing and lower key interest rates possible in the US and the euro area. The fall in long-term interest rates will not be as sharp. Corporate bonds will continue to offer good yield potential.

The equity market will continue to offer reasonable return potential thanks to earnings growth in 2025. Corporate earnings growth will continue as the US remains the driving force. Valuation levels remain elevated in the US equity markets, which limits further price potential. In other equity markets, valuation levels are cheap in comparison to historical levels. Geopolitical and global trade tensions will continue next year. Any escalation or development into a crisis will continue to be a risk for market and economic development.

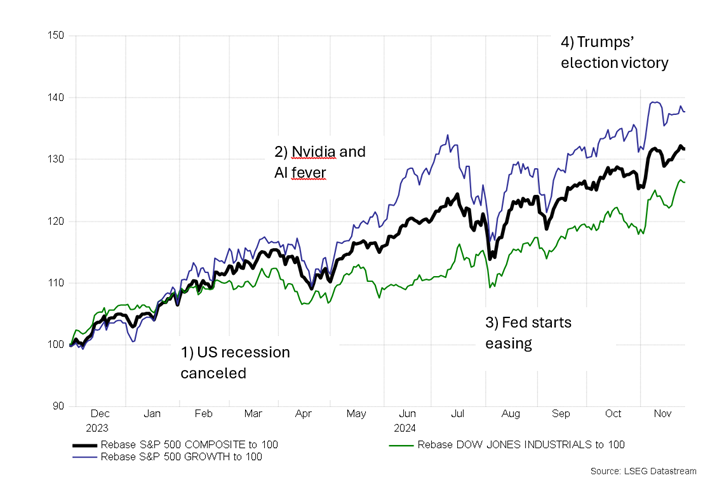

Figure: Four main drivers of the US equity markets in 2024