How will markets react to the US presidential election and the policy agenda of each candidate? Also, why do markets seem so nonchalant concerning surging US debt?

Markets don’t like uncertainty

Markets are closely watching the US presidential election on November 5, which is set to be a tight race. U.S. News reports that 15 counties in swing states could decide the election. Historically stock markets tend to fall in the last three weeks prior to election day, especially with regards to close elections. After the election is over, markets rally no matter who wins.

But that's not to say it doesn't matter who wins. Under Donald Trump, corporate taxes were cut significantly, which ultimately outweighed his destabilising foreign policy. His trade war has become a permanent feature of the US foreign policy map, kept by the Joe Biden administration. Indeed, anti-China sentiment is perhaps the last bipartisan issue in a polarised political landscape.

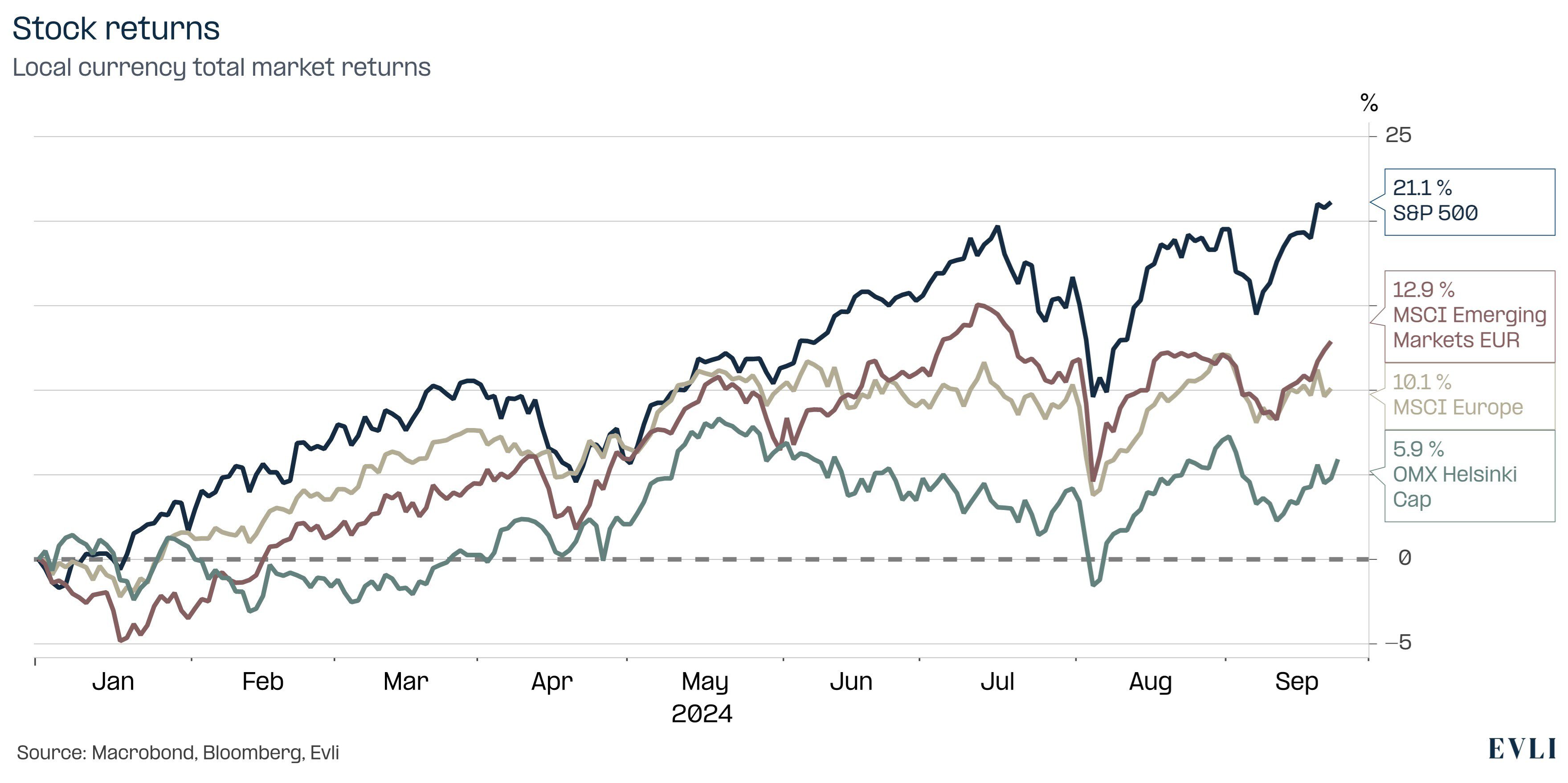

Figure 1: Stock markets have had a great year

Protectionism is in vogue

Protectionism and corporate taxes could be the main channels through which the 2024 election affects markets. Trump's trade wars would hurt both emerging market and European companies. They would also hurt US companies with international operations as Europeans fight back. Kamala Harris's victory would mean higher corporate taxes, which will hit all US companies.

Which is more important depends on relative sizing. However, corporate taxes can only be cut to zero, whilst there is no limit to how high tariffs can be set. In general, corporate tax cuts are more important for company earnings and hence stocks. Tariffs, unless they are extreme, lead to substitution, which although harmful is not as destructive in terms of growth. That is at least what both academic macroeconomics and the first Trump administration tell us.

Most likely a Trump administration would bolster earnings but create more volatility through foreign policy gambits. Hence Trump could boost stock returns, but also increase volatility. A Harris administration would lower both returns and volatility.

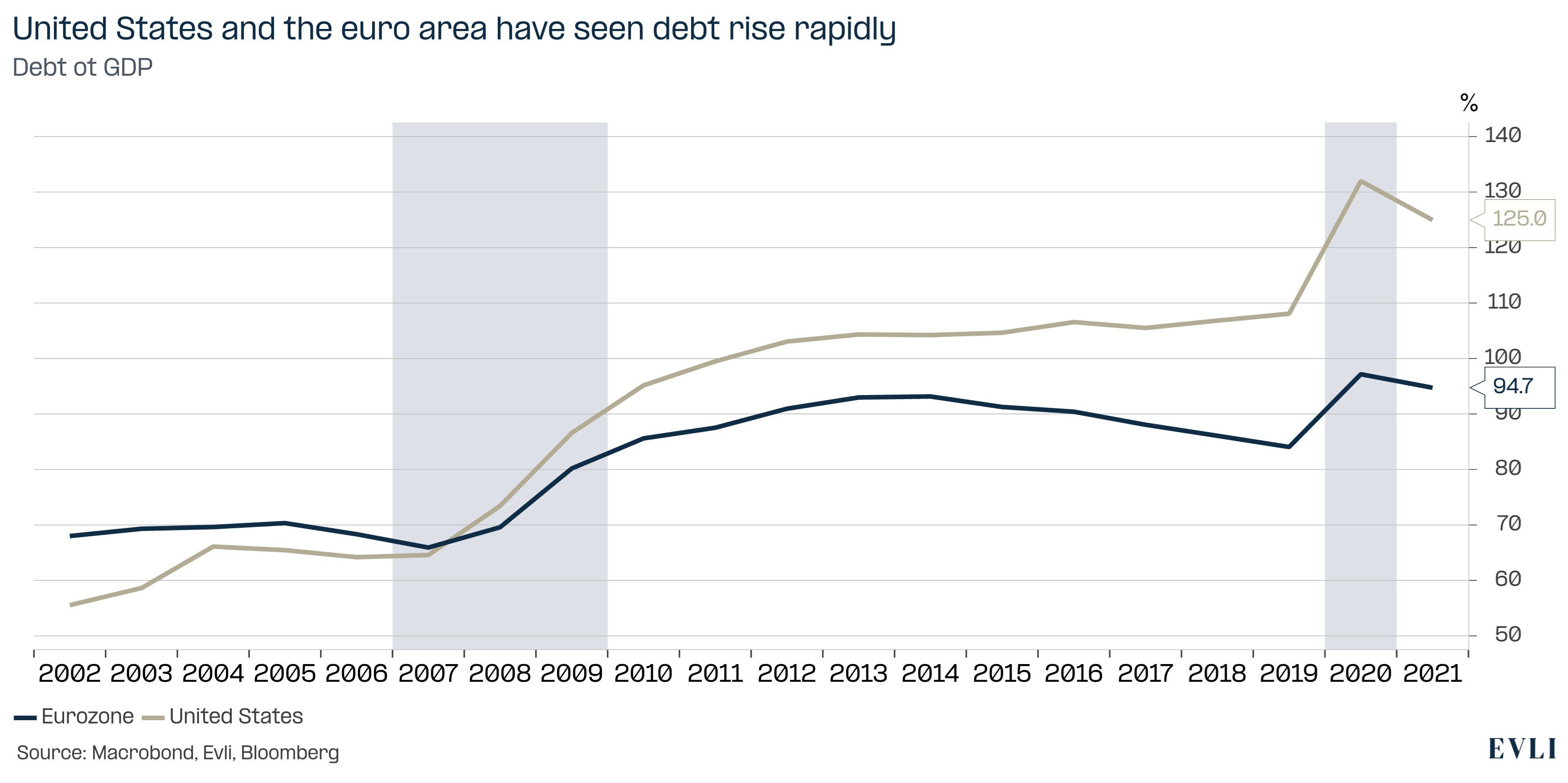

Neither candidate talks about government debt

One would think that debt would be a big issue in the US, where the ratio of public debt to GDP is risen to over 120%. As recently as 2007, the debt ratio was above 60%. Debt is concentrated in the public sector because household and corporations have both deleveraged their balance sheets.

Figure 2: The US government has become increasingly indebted

Money for nothing and bonds for free

With ageing populations, debt should be more of a concern. A key question is therefore how bond markets will react to the ever-increasing debt burdens.

Markets look at several factors in addition to the size of the debt load. Economic growth provides the income to fund debt, which makes it important from the point of view of debt markets. Policy and intent are also of tantamount importance.

UK Prime Minister Liz Truss was forced to resign when the bond market yields spiked in response to her fiscally irresponsible measures. At the time, the UK debt to GDP was just under 90 percent, which much less than US debt currently.

The US has taken on the bond market before. In the early 1990s, the bond market rebelled against Bill Clinton's economic governance and the ten-year interest rate rose from five to eight percent. The ratio of public debt to GDP was a modest 60% at the time. Clinton relented and eventually balanced the budget. The bond market used to be tougher in the old days. Today, US debt is over 120%, yet the US ten-year rate has fallen below 4%.

The old guard of the Republican Party were fiscal hawks that at least talked about fiscal responsibility. What they did was another matter as Ronald Reagan's administration debt spree made clear. Fiscal hawks seem all but extinct as a political species in present day Washington.

The reason bond markets appear nonchalant in the face of US fiscal recklessness may be simple. There is no longer a viable alternative to US Treasuries. In the early 1990s, Europe had yet to show its modern-day economic sclerosis. China was a legitimate growth miracle. The US had real competition. Now, China is in the midst of a housing implosion and Europe has been economically eclipsed by the US for the last three decades.

There is no economic alternative to the US on the horizon.