Perceived problems in the Swedish property sector have seen some international investors exit Nordic corporate credit and equities in 2022 and the early part of 2023. Many signs imply the worst is now behind us and the forward-looking markets are sensing the cyclical macro downturn might have run its course and could be looking to recover next. The darkness is slowly giving way to dawn.

Perceived problems in the property sector often cause jitters among investors who instinctively fear a repeat of the scenarios that triggered the global financial crisis in 2008 and previous cyclical downturns that lead to increased unemployment and lower corporate earnings.

Portfolio managers at Evli, however, are quick to point out that while some real estate companies have certainly proved to be too heavily leveraged in the current interest rate environment, the current macroeconomic setting in the Nordic region is very different today compared to previous slumps.

As for commercial real estate, the highly publicized debacles of some players have rubbed off on the entire sector, which may not be called for. The main culprit, SBB, also relies on a business model that required better governance and lower leveraging. The buying and subsequent leaseback of municipal properties such as schools and care facilities financed with short-term borrowing proved to be untenable when interest rates skyrocketed. The final outcome is also highly dependent on political decision making and municipal budgets, rather than market forces.

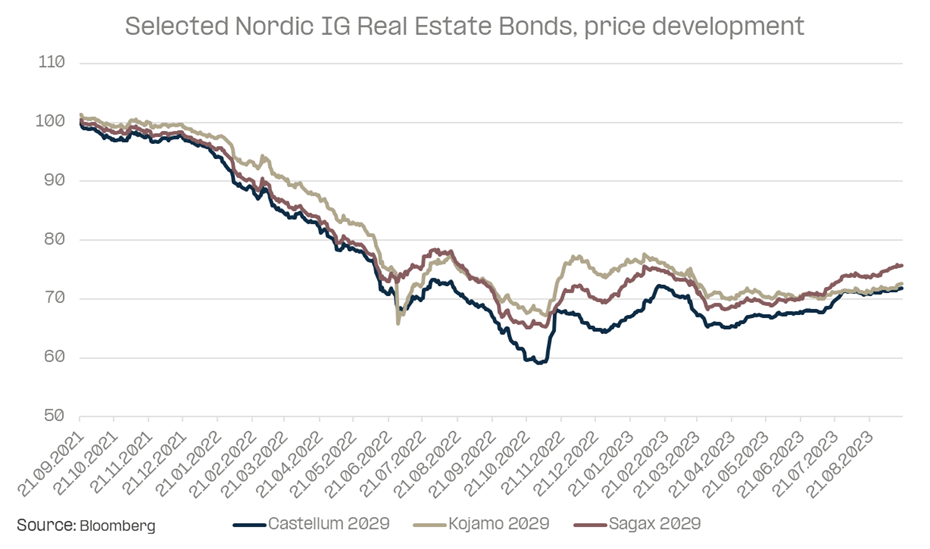

SBB aside, the Swedish property sector appears to have left the worst behind and, consequently, key real-estate equity indices bottomed out some time ago. “Swedish real estate companies have initially replaced bonds with secured bank funding as a cheaper option. The Swedish bond market has now opened for real estate companies as we have seen multiple new unsecured bond issues during the last weeks attracting healthy investor demand.,” says Senior Fixed Income Portfolio Manager Jani Kurppa at Evli and adds that “Investment grade quality (see picture below) Swedish real estate bond prices bottomed out already in October 2022 and have been on the rise since the summer of 2023”.

In fact, very recently SBB announced the sale of some assets to the tune of SEK 8bn (USD 720m) thus securing funding at least for the next two years. The market reaction was striking – SBB stock spiked almost 30% on the day and its short-dated bonds rose 5-8% in response.

As for households, Janne Kujala, Head of Nordic Equities at Evli says they have coped remarkably well with sharply rising mortgage costs: “Swedish households may be among the most heavily mortgaged in the world and they are obviously affected by the sharp uptick in variable interest rates – but the level of financial savings is also among the highest in the world,” he says. “In other words, they can afford it.”

And even if Swedish households are indebted, their country is not. Sweden’s debt-to-GDP ratio is among the lowest in Europe, expected to land at 30.6 percent by the end of 2023. Earlier this year, Karolina Ekholm, Director General of Sweden's Debt Office, said the government had a light debt load and could afford to borrow more to intervene, addressing the possibility of giving credit guarantees or subsidized loans.

Kujala doesn’t think this will be called for, however, as households show little sign of defaulting so far: “Especially Swedish but also Finnish mortgage loans – typically fixed to short term interest rates - have to a large degree (70-80 percent) been repriced already, that is, the higher interest rates have reset in variable interest rate loans and the mortgage rates paid by consumers on existing loans are no longer rising, meaning the pain is no longer getting worse. It might last a little longer but what next? It will abate!”

Recession is another word that doesn’t sit well on investor screens. Evli agrees that Sweden and Finland have indeed entered a mild recession and that the overall Nordic GDP growth is lagging behind the euro area in 2023−24 with zero growth and inflation rates around 7−8 percent in 2023, down to 5−6 percent in 2024.

“This development has little bearing on bond/equity pricing or it has already been priced in. What’s more important is that the recession doesn’t seem to get any worse for households. Jobless rates have not risen and the earnings capacity of households remains robust even if their purchasing power is squeezed by inflation, a weak currency and rising interest rates.”

The weak Swedish and Norwegian currencies may be bad for households who have to pay more for imported goods, but the de facto depreciation is a certainly a golden egg for the export sector and by extension to the export-driven economies as a whole. Export-orientated companies in Sweden and Norway are enjoying record competitiveness in export markets and manufacturing activity is showing signs of picking up. Plus, the oil price has started to climb. The rising energy costs are – and continue to be – a relative competitive advantage for the mostly energy self-sufficient Nordic exporters.

While the Swedish krona may recently have hit all-time lows against the euro and the dollar, the central bank governor feels it is only matter of time before it, too, bounces back. In a speech in September, Erik Thedéen, Governor of the Riksbank, pointed out that the krona cannot drift away indefinitely. “The longer it is undervalued and the weaker it becomes, the stronger the forces will become that protect against further weakening and work towards strengthening. We are a small open economy that has a lot of trade with our neighbours. When the krona is weak, it becomes profitable to invest in Sweden. Swedish equities, bonds, property, etc. should therefore ultimately appear attractive to foreign investors. In addition, exports will benefit and imports will be disadvantaged. Increased tourism and the purchase of more expensive capital goods by foreign private individuals, such as cars and boats, also favour demand for the krona,” he said and concluded that “when many factors eventually move in the same direction, the krona will strengthen and this could go quickly.”

Real wages have declined but have troughed out since inflation is declining and salaries are rising with a lag. Unemployment is not measurably rising and employment is strong, while de-stocking in industry has likely run most of its’ course.

One sign that households appear to be handling the multi-pronged squeeze is the absence of rising credit losses among the banks. All major Nordic bank balance sheets are rock solid with CET1 ratios around 20 percent, non-performing loans are non-existent and the banks have passed recent regulatory stress tests with flying colours. In addition, Nordic banks risk premiums demanded by investors in the bond and equity markets have remained low with modest volatility, indicating investor confidence in earnings prospects.

Moreover, an ongoing recession does not necessarily spell a disaster for stocks and bonds, the valuations of which depend on what the market thinks about the future in terms of further rate hikes and corporate earnings. Most observers agree that the Fed, ECB as well as Nordic central banks are nearing their final hike this cycle, while corporate earnings are poised to recover (lead by exporters currency-boosted earnings).

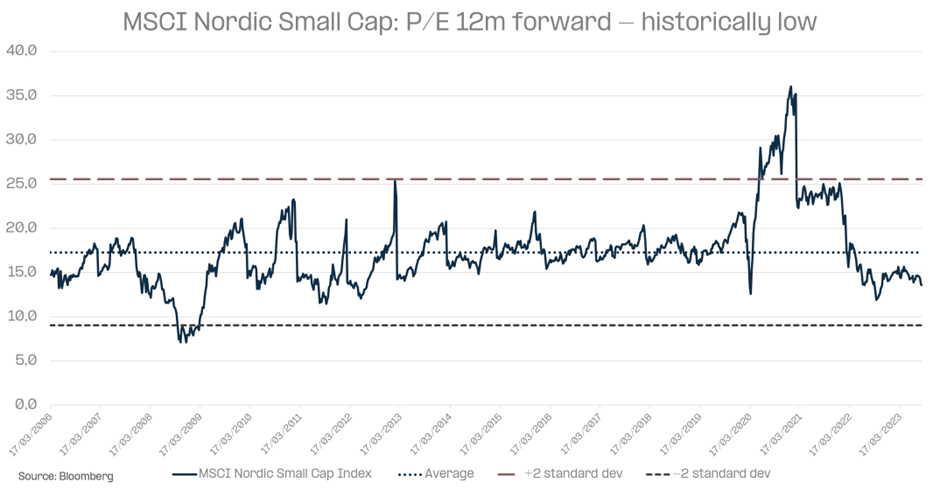

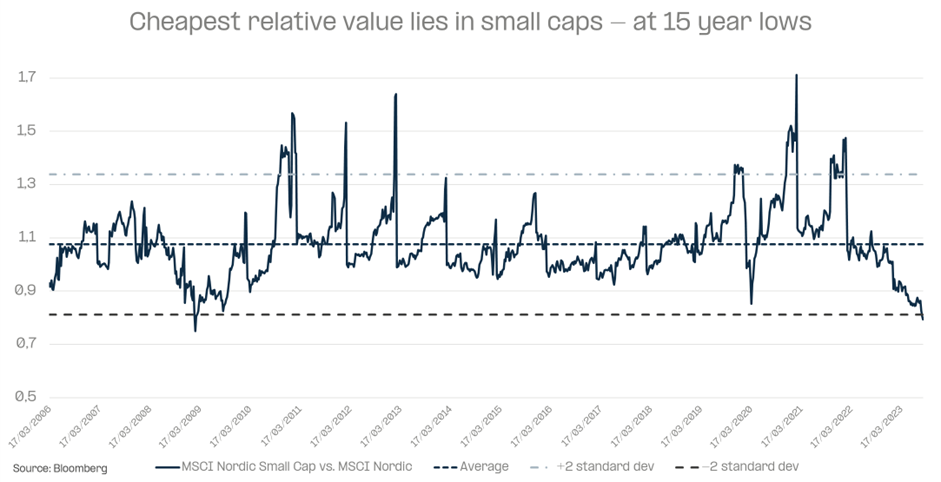

“Equity valuation levels are currently below long-term historical averages, especially in small caps, even while earnings estimates have trended down” says Kujala.

Whether justified or not, the conclusions drawn by some international investors have made them take their money and run, notes Kujala. “International ownership, particularly in perceived problem areas is low. Domestic investors, who usually have a more nuanced view of where the real risks and opportunities lie, have certainly returned to Nordic equities and bonds.” Domestic inflows, particularly into corporate credit funds, have turned positive some time ago in Norway, Sweden and Finland. In other words, the flight of recovery may be about to take off and remaining on the sidelines of the Nordic financial markets may result in missed opportunities. “Go to gate, your flight is boarding” concludes Kujala, and adds that “it’s always darkest just before dawn.”