In early September, equity markets began to doubt that the US Federal Reserve would cut its policy rate by 0.50 percentage points after all. To the delight of the markets, the Fed did, however, do what its Chair Jerome Powell had indicated it would. Warnings that a large rate cut would lead to recession were quickly pushed aside. After a mildly negative initial equity market reaction, the US equity market surged to new all-time highs.

The European Central Bank made its decision to cut the deposit rate by 0.25 percentage points before the Fed made its decision. As previously announced, the spread between the main refinancing operations rate and the deposit rate was set at 0.15 percentage points as of September and as a result, the refi rate fell by 0.60 percentage points to 3.65 percent.

Bank of China announced its biggest stimulus since the pandemic with the aim of pushing the Chinese economy back toward the government’s growth target. The reserve requirement for banks was reduced by 0.5 percentage points and will be reduced further, if necessary. The central bank also cut its other policy rates and announced a total of 800 billion yuan in loan programs to boost capital markets.

The goal of China’s leadership is to achieve annual economic growth of around 5 percent by 2024 and to halt the decline in the housing market. To achieve these goals, China is recapitalizing the biggest state-owned banks, helping local governments to resolve their debt problems and issuing up to 2 trillion yuan in loans as part of a fiscal stimulus plan.

The Bank of England made no changes to its policy rate in September, and Sweden’s Riksbank settled for a rate cut of 0.25 percentage points. All in all, the central bank measures seen in September reinforced global expectations of further monetary easing. In the fixed-income markets, the three-month Euribor interest rate is expected to decline by more than 1.5 percentage points from its current level to a low of 1.81 percent in December 2025. By the end of next year, the Fed funds rate is expected to be 2.86 percent, down from the current 4.75 percent.

Markets welcomed monetary easing

Despite the dour comments made by some analysts and economists, the decisions to ease monetary policies were welcomed by the equity and fixed-income markets. The MSCI China index led the major markets in September, rising by almost 25 percent after the rate decision. In the US and Europe, equity markets rebounded from their early-September slump to finish the month with a 1 to 2 percent improvement.

Long rates continued to decline, with the US and German 10-year rates falling by 0.12 to 0.15 percentage points. Yield curves flattened out, however, and turned positive as two-year rates fell more than 10-year rates. A steepening of the yield curve from negative levels has in the past foreshadowed an economic downturn. Moreover, the economic indicators published in September were on the weak side, adding to economists’ mixed expectations.

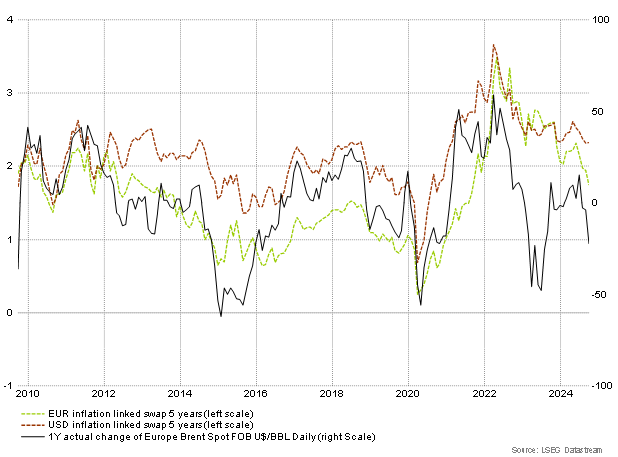

Crude oil prices fell to near two-year lows despite the increasingly tense situation in the Middle East. Weak global demand and continued abundant supply are sustaining a weak outlook for crude prices.

Figure: the fall in crude oil prices has contributed to falling inflation expectations