Responsible investing plays an essential role in fighting climate change. We at Evli have set a goal to be a net zero asset manager by 2050. To achieve our goals, we have further developed our climate work and joined several global initiatives with the aim to mitigate climate change and biodiversity loss. In this blog post, we look at our roadmap and the concrete actions toward carbon neutral asset management.

Many significant economic, social, and environmental risks are associated with climate change. One of the most important ways to control it is through real world carbon emissions reductions. Achieving carbon neutrality demands impactful actions in all aspects of society and the economy, including asset management.

By now every asset manager should be setting concrete climate goals that steer investing activities toward a sustainable direction and support the goal of limiting global warming to 1.5 degrees Celsius. Our goal at Evli is to halve the carbon emissions of our investments by 2030, so by 2050 at the latest, we would be a carbon neutral asset manager. In addition, our goal is to be net zero in terms of emissions from our own operations by 2025.

Setting ambitious goals is not enough, however. Carbon neutral asset management requires a concrete roadmap, impactful actions, effective ways to measure progress, and collective power from all investors.

Towards carbon neutrality in all asset classes

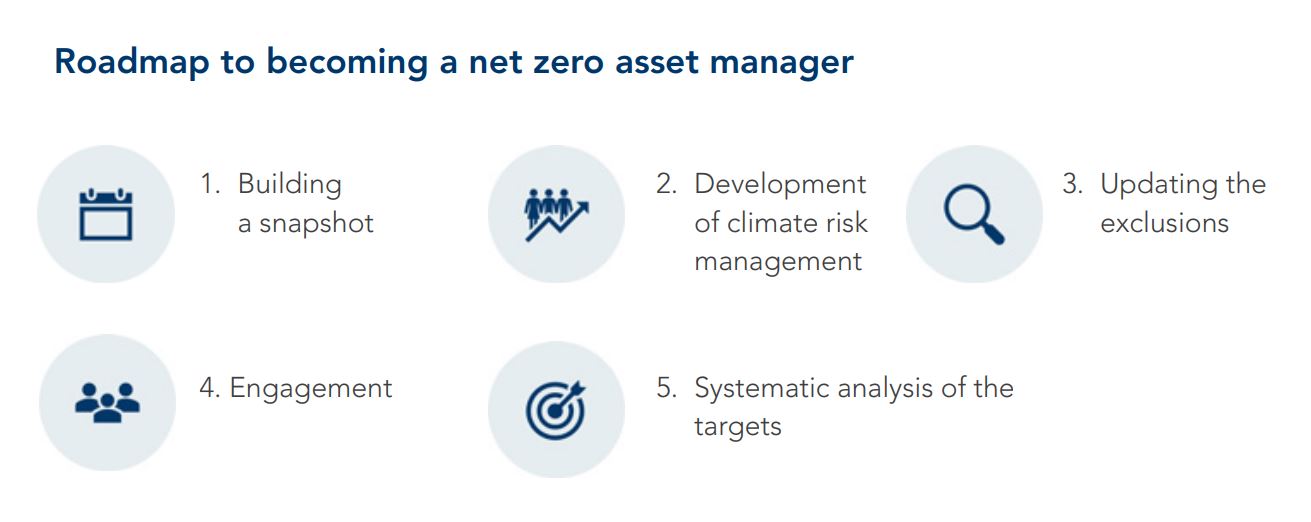

There are several steps in our roadmap towards carbon neutrality. We have already mapped the most significant sources of emissions, created new ways to calculate the emissions and set a working committee to assess how the investment-related interim targets can be reached through real world emission reductions and to ensure alignment with the Paris Agreement. In addition, we will continue to reassess and develop our climate risk management, our principles for responsible investing, practice active ownership, and systematically evaluate progress towards our goals.

At its simplest, carbon neutrality could be pursued by simply excluding the highest-emitting sectors from the portfolio. This, however, is a very short-sighted strategy.

To make real impact, we should not completely eliminate investments in the high-emission industries, such as the energy and metal sectors, but instead focus on the best, most efficient solutions towards green transition. The ever-tightening climate regulation and active ownership from stakeholders are effective ways to push companies to improve their operations.

All this tied together, and it is evident that pursuing carbon neutral asset management is not solely in the hands of a centralized sustainability team, but in fact requires effort and collaboration across the organization. As our portfolio managers explain, each asset class has unique characteristics that impact how carbon emissions are evaluated and reduced. Thus, we need to consider asset class-specific divergences when evaluating our goals and actions.

Net Zero Asset Managers initiative demonstrates the investors’ collective power

To further strengthen our climate pledge, we signed the Net Zero Asset Managers (NZAM) initiative in the summer of 2022. Among the signees are a vast number of global investors and asset managers committed to achieving carbon neutrality by 2050. Together, the signees have over 61 trillion USD under management.

The initiative requires several actions from the signees. Asset managers must fulfil requirements such as setting intermediate targets and pursue yearly progress reporting. Asset managers must also set a clear roadmap and engage in active ownership.

The greatest opportunity in initiatives such as the NZAM is in numbers. As the signees include the world’s largest asset managers and respected partner organizations such as the CDP (Carbon Disclosure Project) and PRI (Principles for Responsible Investment), the entire industry can show it takes cutting emissions seriously and is willing to take concrete actions. In addition, the initiative steers companies in the industry to lower emissions and report on their progress in a unified manner, which helps to evaluate progress from a wider lens.

We need a broader view of climate risks, including biodiversity loss

The wider effects of climate change have been discussed for a long time, but there have been challenges in measuring them. As climate change further accelerates biodiversity loss, investors should aim to evaluate the broader effects of climate risks regarding, for example, water and critical landareas. As over half of the global gross domestic product is either somewhat or strongly dependent on nature and its services, biodiversity is vital to company operations.

Evli was the first Finnish asset manager to join the Taskforce on Nature-related Financial Disclosures Forum in the summer of 2022. The forum aims to develop a reporting framework for investors to understand the impact and dependencies of their activities and nature-related risks and opportunities.

Through these new initiatives and continuous development of our activities, we strive to take the effects of our investments into account even more widely and further develop our operations towards carbon neutrality.

Our roadmap towards carbon neutrality:

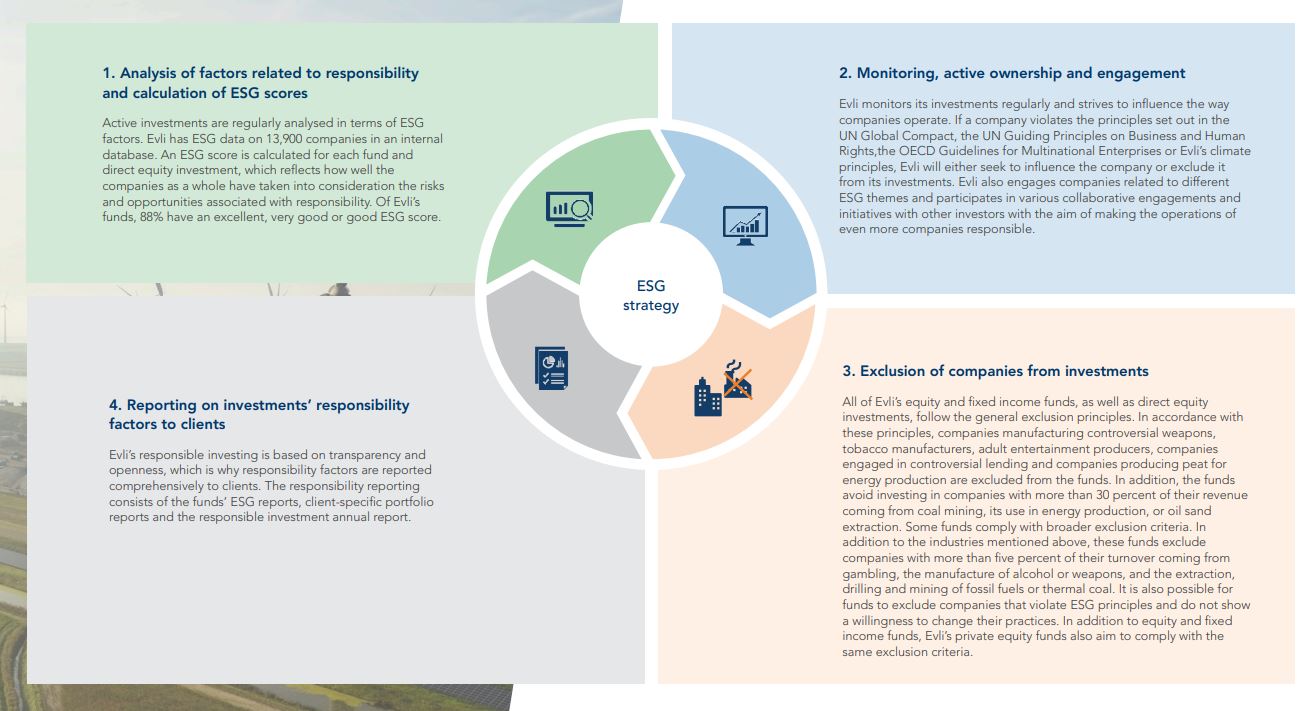

Evli's ESG strategy:

Petra Hakamo, Head of Sustainability at Evli Plc. M.Sc. Economics (London School of Economics & Aalto University), B.Sc. in Business Administration and Political Science (Stockholm University). Strong expertise in finance and sustainability across large corps, institutional clients as well as growth equity.

Jenni Moilanen, Responsible Investment Analyst trainee at Evli Plc. M.Sc. Economics, University of Vaasa. During Evli's Trainee Program, Jenni has worked for example on biodiversity-related tasks.

Jenni Moilanen, Responsible Investment Analyst trainee at Evli Plc. M.Sc. Economics, University of Vaasa. During Evli's Trainee Program, Jenni has worked for example on biodiversity-related tasks.