The summer witnessed true suspense in both politics and the capital markets.

In the US presidential race, the stakes were raised first by the failed assassination attempt on Donald Trump and then by the withdrawal of Joe Biden, the incumbent president. The Democrats eventually persuaded Vice President Kamala Harris to stand for election. Surprisingly, Harris’s campaign was well received.

No significant new information was learned about the candidates’ economic programs. Harris is likely to continue the policies set out by Biden, while Trump will tear apart the Democrats’ achievements. Trump’s policies are seen as benefiting many American businesses but harming other countries.

In the Middle East, hostilities continued between Israel and Iran, as well as between Israel and the extremist organizations Hamas and Hezbollah. In the war in Ukraine, Ukraine managed to launch a surprise counter-attack on Russia and at least partially turn the tide in its favor.

A brief slump on equity markets

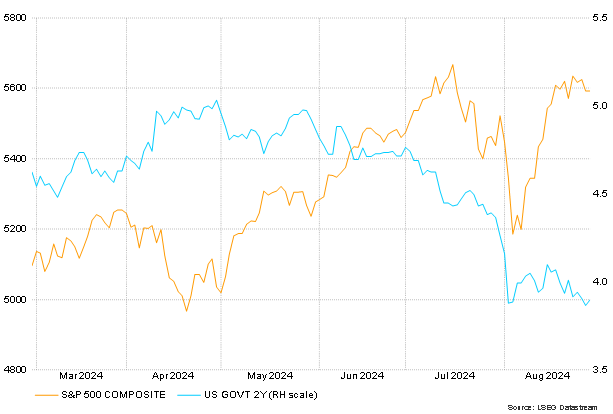

US equity markets saw a three-day slump at the turn of July and August. The S&P 500 index declined 6 percent, while the Nasdaq 100 index declined 7.6 percent. The indices had previously fallen by almost the same amount from their July peaks. They recovered almost as quickly, however, and compared to the end of June, the Nasdaq 100 index was slightly negative at the end of August, while the S&P 500 index was a couple of percent higher.

The slump was caused by several simultaneous events. US employment figures for July were weaker than expected, which actually triggered talk of a possible recession. A rise in unemployment has previously signaled an approaching recession. This time, the rise in unemployment is not due to redundancies but to an increase in labor supply, however.

The mood was overshadowed by weaker manufacturing expectations, with the ISM index of US manufacturing falling from 48.5 to 46.8 points. In the last week of July, a number of major tech companies also published their results, which received a mixed reaction on the market. On top of all this, the Bank of Japan unexpectedly raised its policy rate, triggering a closing of yen-funded equity and interest rate positions.

Fed Chair anticipates a cut in policy rates

Equity market jitters quickly raised expectations of monetary easing. Expectations for the Federal Reserve's September rate decision grew stronger and the policy rate is expected to fall by 0.50 percentage points. The easing is expected to continue at a rapid pace and the Fed funds rate is expected to fall to 3 percent by early 2026. The equity markets recovered, but interest rates remained at lower levels.

In his speech, Jerome Powell, the Fed Chair, said that the time had come to adjust monetary policy: “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” US inflation is at 2.9 percent, which is encouraging, and markets expect service prices and wage pressures to ease as employment weakens.

Figure: US two-year interest rate falls despite equity market rebound from summer slump