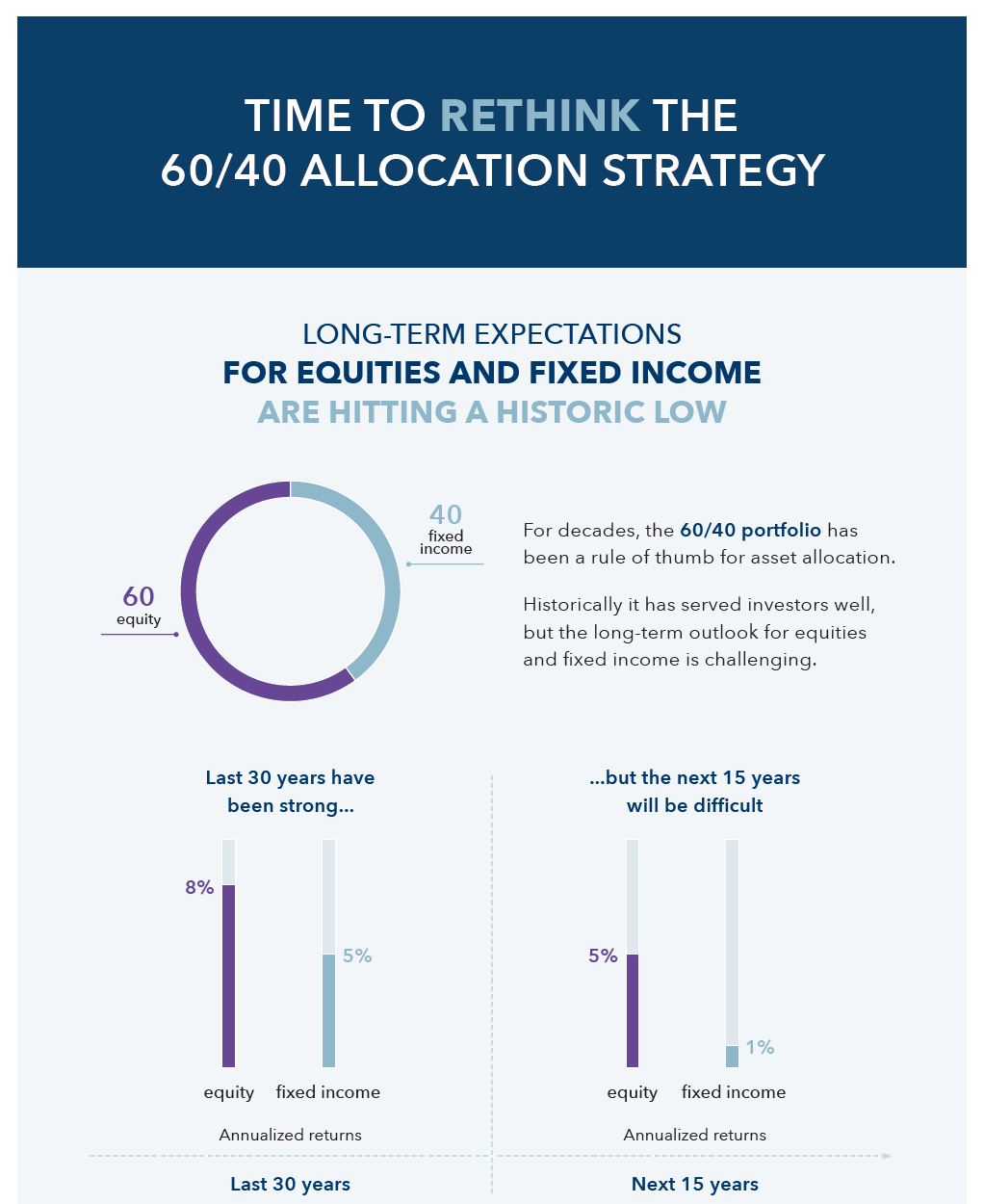

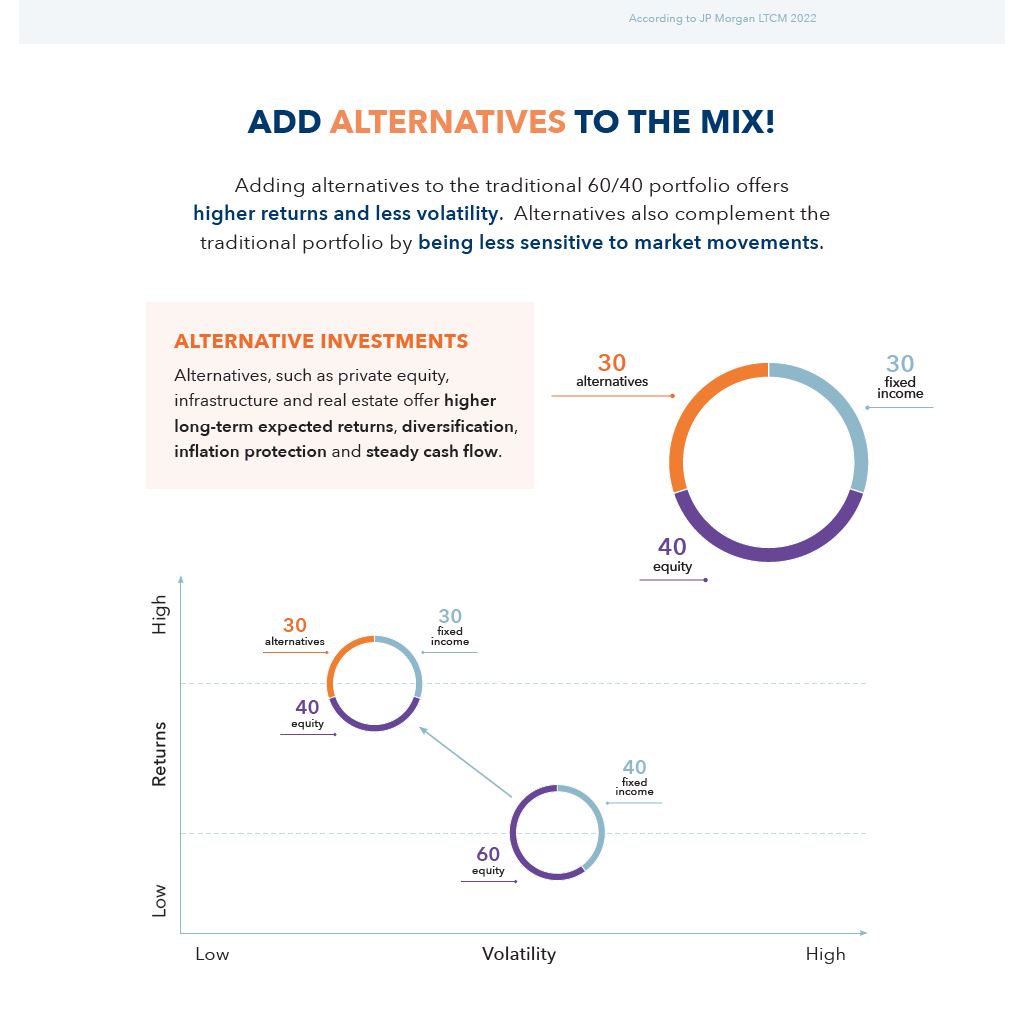

The 60/40 allocation strategy has historically served investors well, but the long-term outlook for equities and fixed income is challenging. Alternatives complement the traditional portfolio by being less sensitive to market movements.

Click the image below to open the infographic.

Read also

When in dire straits – hoist the sail labelled diversification

Unlisted infrastructure offers unrivalled downside protection

Forestry leads the way towards a carbon-neutral portfolio

Private Debt provides stable income and excellent risk-adjusted returns

Private equity allows access to attractive sectors and companies outside listed markets

Unlisted real estate adds stability to the portfolio in the long run