Investing is, fundamentally, about balancing risk and return. ESG investing, or considering the environmental, social and governance factors adds a third component to this balance. Recently investors have started to look for better ways not only to integrate ESG matters in investment decisions but to contribute to measurable positive change for people and planet alongside generating competitive financial return.

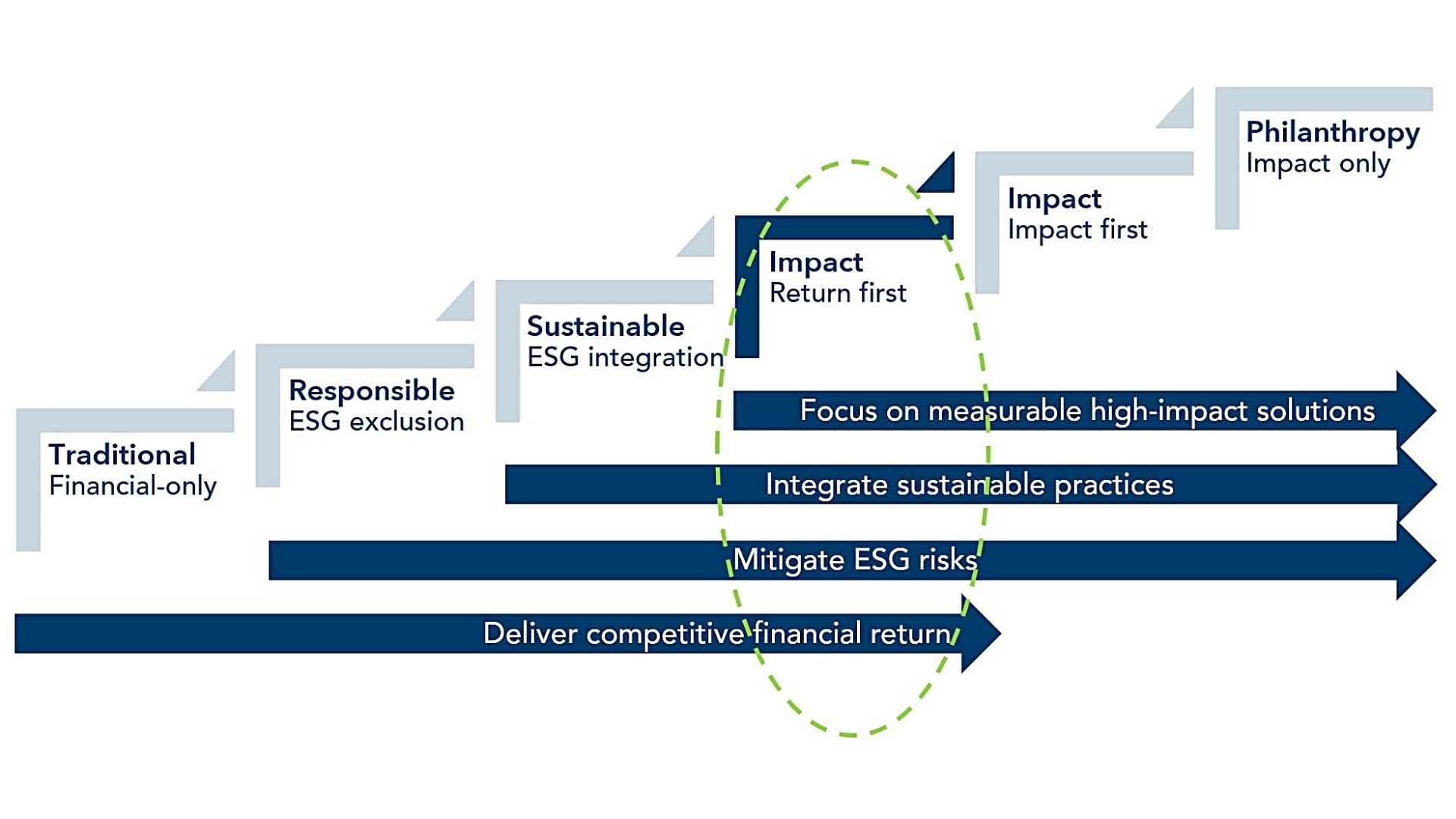

An excellent way to illustrate the evolution of ESG investing is to think of a spectrum where the financial-only style of investing is on one end and pure philanthropy is on the other. Over the years, investor sentiment has steadily moved from focusing on purely financial goals towards intentionally investing for impact, a measurable positive change in environmental or social outcomes. As investors move along the spectrum of capital, financial risk and return objectives evolve as well.

The Spectrum of Capital: What is your Investment Objective? Adopted from: G8 Social Impact Investment Taskforce, Asset Allocation Working Group (2014)

Adopted from: G8 Social Impact Investment Taskforce, Asset Allocation Working Group (2014)

The first step after traditional investing is responsible investing. Responsible investors voice their concerns about environmental, social or governance matters and mitigate risky ESG practices to protect investment value. Responsible investing has been implemented at large through different kinds of exclusions: norms-based exclusions, sector exclusions or exclusions based on business conduct. There is inconsistent evidence of how exclusions affect the portfolio’s risk-adjusted returns. Recent studies show that exclusions lead to “about the same or worse performance than the benchmark index” (SEC inquiry on ESG issues, May 2020).

The next step along the spectrum is to invest sustainably. Material ESG risks and opportunities are considered and integrated in the investment analysis and portfolio construction. According to academic studies, adopting progressive ESG practices enhances investment value and allows to attain higher risk-adjusted returns (Morgan Stanley, 2019). Evli has been a UN PRI signatory since 2010 and has been actively pursuing ESG integration.

"Impact investing has today become a viable way to do good and to get competitive financial return.”

The latest development in investing has been to pursue impact investing strategies. Here, investors intentionally focus on investing in measurable high-impact solutions. While back in the day impact investing was associated with philanthropy and below-market returns, today it has become a viable way to do good and to get competitive financial return.

What is returns-based impact investing?

An impact fund states a clear intention, defines fund objectives for positive environmental and social outcomes and follows up with management and measurement of these objectives. Academic research has found evidence that investors can make a significant environmental or social impact by investing in publicly listed impact companies without compromising and even gaining in financial returns (Blaauwgeers, 2016).

To be considered an impactful company, it is not enough that the company has fancy UN SDGs icons in its annual report or claims that it commits to the Paris Climate Agreement. Instead, it must deliver high-impact solutions to the most pressing needs. For example, if a company produces low carbon technology, product or solution, this solution needs to demonstrate substantial green house gas (GHG) emission savings compared to the best performing alternative solution available on the market. Similarly, if a high-water intensive company such as a textile producer operates in high water stressed area, it can deliver significant positive environmental and social impact by improving its water efficiency while ensuring water access to local communities.

There are many reasons why impact investing has become an attractive option for return-seeking investors. Climate action is high on the agenda, sustainable technology has matured over the years, the regulatory landscape is changing, and consumers, asset managers and asset owners are putting a heavier emphasis on sustainable practices.

John Bogle, the founder of Vanguard, said, “earnings growth and dividend yield are a fundamental portion of stock market returns”. Returns-based impact investing shifts the focus from protecting investment value to investing in value accretive opportunities, for example focusing on the growth potential of companies that deliver renewable energy technology as the EU targets doubling renewable energy balance by 2030. Likewise, companies that undergo operation transition might offer growth opportunities. For example, several traditional car manufacturers in Europe are investing heavily to offer Electric Vehicles by 2024–2027 to better meet customer preferences and regulatory requirements – and likely grow earnings as well.

Movement to low carbon economy is not fully priced by financial markets. Likewise, social issues such as affordable healthcare or accessible education are not on the top of agenda. Yet, we are to see a massive shift in investment objectives, as wealth is transferred to Millennials. This creates profit opportunities in impactful companies that are underlooked currently.

”Returns-based impact investing shifts the focus from protecting investment value to investing in value accretive opportunities and offers an appealing way to do good while doing well.”

Impact strategies have proven to work well from the return perspective. A survey by the Global Impact Investors Network in 2020 found that in 68 per cent of cases, impact strategies that go after market-rate returns perform in line with expectations. In 24 per cent of cases, these strategies outperform market rate expectations. These findings are confirmed by the Impact Investing Institute report published in 2022, saying that 90 per cent of UK based impact investors reported financial returns for 2021 that were either in line with or exceeded their investment targets.

For an investor looking to contribute to measurable positive environmental and social impact while generating competitive financial return, returns based impact investing offers an appealing way to do good while doing well.

Olga Marjasova, Portfolio Manager, Evli Fund Management Company. Executive Master of Business Administration, Aalto University Executive Education Ltd. Investing for a sustainable, diverse and inclusive world. 15 years of experience as equity fund manager. Started at Evli in 2003.

Olga Marjasova, Portfolio Manager, Evli Fund Management Company. Executive Master of Business Administration, Aalto University Executive Education Ltd. Investing for a sustainable, diverse and inclusive world. 15 years of experience as equity fund manager. Started at Evli in 2003.

Petra Hakamo, Head of Sustainability at Evli Plc. M.Sc. Economics (London School of Economics & Aalto University), B.Sc. in Business Administration and Political Science (Stockholm University). Strong expertise in finance and sustainability across large corps, institutional clients as well as growth equity.

Petra Hakamo, Head of Sustainability at Evli Plc. M.Sc. Economics (London School of Economics & Aalto University), B.Sc. in Business Administration and Political Science (Stockholm University). Strong expertise in finance and sustainability across large corps, institutional clients as well as growth equity.